Money Tips

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

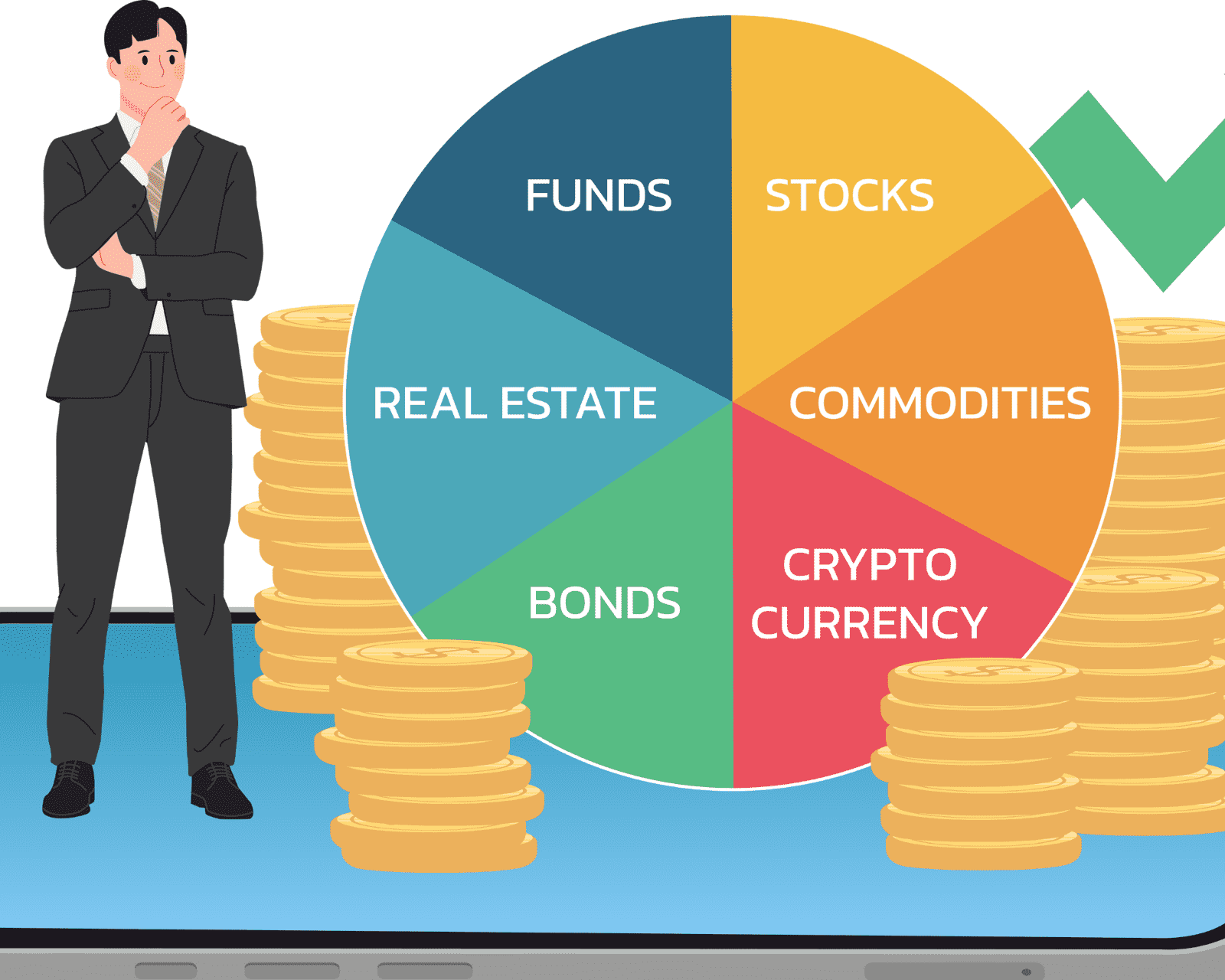

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.

Best Place to Invest Money Without Risk

Best Place to Invest Money Without Risk

Investing money is a wise financial decision, but the fear of losing money often deters individuals from exploring investment opportunities. However, there are several risk-free investment options available that can provide a stable return on investment.

Pay Off Debt or Invest During a Recession

Pay Off Debt or Invest During a Recession

During times of economic uncertainty, such as a recession, individuals are faced with difficult financial decisions. One common dilemma is whether to pay off debt or invest.

Pay Off Debt or Invest in Real Estate

Pay Off Debt or Invest in Real Estate

When it comes to managing personal finances, one common question arises: should you pay off debt or invest in real estate?

Is it Worth it to Get a Personal Loan to Pay Off Debt?

Is it Worth it to Get a Personal Loan to Pay Off Debt?

While a personal loan can offer certain advantages, it is essential to thoroughly evaluate its worthiness before proceeding. In this article, we will analyze the pros and cons of obtaining a personal loan to pay off debt, helping you make an informed decision.

Conscious Spending Plan: Taking Control of Your Finances

Conscious Spending Plan: Taking Control of Your Finances

In today's fast-paced world, managing our finances can often feel like a daunting task. With numerous bills to pay, unexpected expenses cropping up, and the temptation to spend impulsively, it's no wonder that many people find themselves struggling to make ends meet. However, by adopting a conscious spending plan, individuals can take control of their finances and pave the way to a more stable and secure future.

Travel or Save Money: How to Do Both and Make the Most of Your Adventures

Travel or Save Money: How to Do Both and Make the Most of Your Adventures

Exploring the world and traveling to exotic destinations is a dream cherished by many. Yet, the cost of travel can often be a major concern, hindering us from embarking on our dream journeys. However, with careful planning, a strategic mindset, and a little insider knowledge, it is absolutely possible to travel without breaking the bank. In this article, we will unveil some savvy tips and tricks that will enable you to travel affordably and save money along the way.

How to Make Money in the Recession?

How to Make Money in the Recession?

In times of economic uncertainty, such as a recession, finding ways to make money becomes crucial for financial stability and growth. The impact of a recession affects various industries and individuals differently, and it is essential to explore strategies that can help navigate these challenging times. This article provides valuable insights and practical tips on how to make money in the recession.

Financial Habits of the Wealthy

Financial Habits of the Wealthy

When it comes to financial success, the habits and practices of the wealthy can provide valuable insights and lessons. Understanding the financial habits of those who have achieved significant wealth can help us learn from their experiences and apply their strategies to our own lives. In this article, we will explore the financial habits of the wealthy that are commonly observed among the wealthy and how they contribute to their success.

Where to Invest Money in Times of Inflation?

Where to Invest Money in Times of Inflation?

During times of inflation, investors face unique challenges as the value of money erodes over time. It becomes essential to strategically invest in assets that can protect and grow wealth in the face of rising prices. In this article, we will explore various investment strategies that can help individuals navigate the impacts of inflation and maximize their returns.

Money Management Strategies During Inflationary Time

Money Management Strategies During Inflationary Time

Inflation, the persistent increase in prices over time, can have a significant impact on personal finances. It erodes the purchasing power of money, decreases the value of savings, and challenges individuals to effectively manage their wealth. In this article, we will explore various money management strategies that can help individuals navigate financial uncertainties during an inflationary period.

How to Buy a House with Low Income and No Down Payment?

How to Buy a House with Low Income and No Down Payment?

Becoming a homeowner is a dream for many individuals, but it can seem out of reach for those with low income and no down payment. However, with careful planning and exploring various options, it is possible to achieve this goal. In this article, we will guide you through the process of how to buy a house with low income and no down payment.

How to Save Money While Renting an Apartment?

How to Save Money While Renting an Apartment?

Renting an apartment can be an exciting experience, whether it’s your first time on your own or you’re looking for a change in location. However, the cost of renting can add up quickly, especially if you’re not careful. In this article, we’ll explore some tips and tricks for how to save money while renting an apartment.

How to Get Lower Rent on an Apartment?

How to Get Lower Rent on an Apartment?

Are you tired of paying high rent on your apartment? Well, you’re not alone. Rent prices are continuously increasing and eating into larger portions of our monthly incomes. But, fortunately, there are several proven ways to get lower rent on an apartment. In this article, we will delve into some of the best tips for saving money on rent.

Living a Debt-Free Life: Tips for Achieving Financial Freedom

Living a Debt-Free Life: Tips for Achieving Financial Freedom

Living a debt-free life may seem like an impossible dream, especially in a world where credit cards and loans are readily available.

Vacation Property Investment Loans: What you should know

Vacation Property Investment Loans: What you should know

Vacation property investment loans are a type of loan that investors can use to purchase a vacation home or rental property. These loans are designed specifically for real estate investors and offer a range of benefits, including flexible terms, competitive interest rates, and low down payments. Here's what you need to know about vacation property investment loans.

Top 6 Mortgage Loan Tips and Tricks

Top 6 Mortgage Loan Tips and Tricks

Buying a home is a significant financial decision, and finding the right mortgage loan can be a daunting task. However, with the right tips and tricks, borrowers can navigate the process and secure the best possible loan for their needs. Here are some mortgage loan tips and tricks to keep in mind.

5 Best Mortgage Broker Tips for Success

5 Best Mortgage Broker Tips for Success

Mortgage brokers play a vital role in the real estate industry, connecting borrowers with lenders and helping them secure financing for their dream homes. However, the competition in this field is fierce, and success as a mortgage broker requires more than just knowledge and expertise. Here are some mortgage broker tips for success.