Top 6 Mortgage Loan Tips and Tricks

Buying a home is a significant financial decision, and finding the right mortgage loan can be a daunting task. However, with the right tips and tricks, borrowers can navigate the process and secure the best possible loan for their needs. Here are some mortgage loan tips and tricks to keep in mind.

1. Check your credit score

Before applying for a mortgage loan, borrowers should check their credit score. Lenders use credit scores to determine the borrower's creditworthiness, and a higher score can lead to better loan terms and lower interest rates. Borrowers with lower credit scores may need to work on improving their score before applying for a mortgage loan.

2. Shop around for the best rates

Borrowers should shop around for the best mortgage loan rates and terms which is one of mortgage loan tips and tricks. This means researching different lenders and comparing their offers.

It's important to consider not just the interest rate but also the loan fees, repayment terms, and other factors that can impact the overall cost of the loan.

3. Consider a pre-approval

Getting pre-approved for a mortgage loan can be beneficial for borrowers. A pre-approval can help borrowers understand how much they can afford and make the homebuying process more efficient. It also shows sellers that the borrower is serious about buying a home.

4. Don't borrow more than you can afford

It's important for borrowers to consider their budget and not borrow more than they can afford to repay which is also one of mortgage loan tips and tricks. This means taking into account monthly mortgage payments, as well as other expenses such as property taxes, insurance, and maintenance costs. Borrowers should also have a plan in place for unexpected expenses or changes in their financial situation.

5. Consider a shorter loan term

While longer loan terms may have lower monthly payments, they can end up costing more in the long run due to higher interest rates. Borrowers should consider a shorter loan term, such as a 15-year mortgage, if they can afford the higher monthly payments. A shorter loan term can also help borrowers build equity in their home faster.

6. Get professional advice

Borrowers should consider seeking professional advice from a mortgage broker or financial advisor which is a great one of mortgage loan tips and tricks. These professionals can provide guidance on finding the best loan for the borrower's needs, as well as offer insights into the homebuying process and other financial considerations.

In conclusion, finding the right mortgage loan requires careful consideration and research. Borrowers should check their credit score, shop around for the best rates, consider a pre-approval, not borrow more than they can afford, consider a shorter loan term, and seek professional advice. By following these mortgage loan tips and tricks, borrowers can make informed decisions and secure the best possible mortgage loan for their needs.

Top 6 Mortgage Loan Tips and Tricks

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

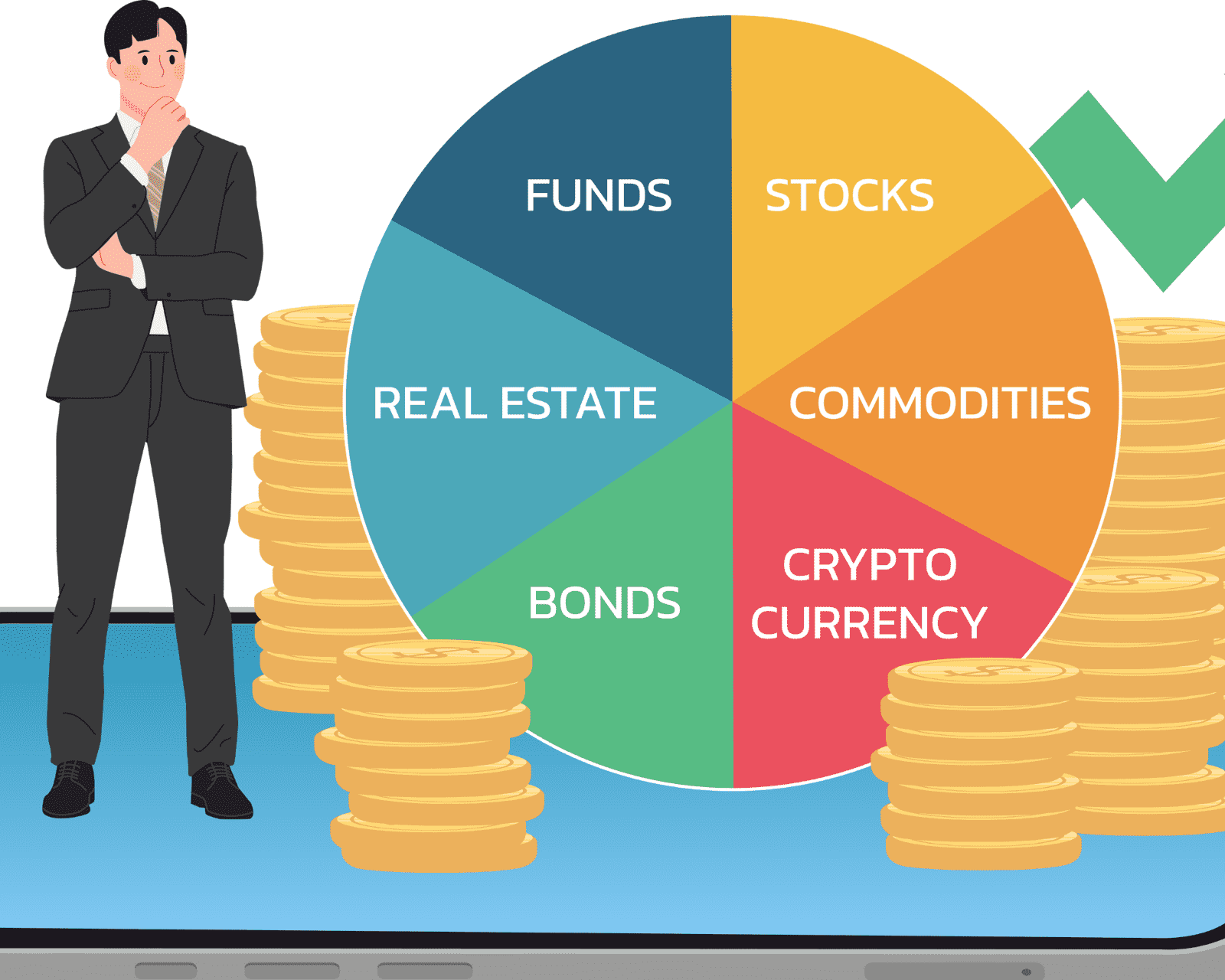

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.