Pay Off Debt or Invest in Real Estate

When it comes to managing personal finances, one common question arises: should you pay off debt or invest in real estate? Both options have their merits and considerations, and making the right decision requires careful analysis. In this article, we will explore the pros and cons of paying off debt and investing in real estate, providing insights to help you make an informed choice.

I- Pros of Paying Off Debt

1. Reducing Financial Stress

Paying off debt can bring a sense of relief and peace of mind. It eliminates the burden of monthly payments and reduces the stress associated with being in debt.

2. Saving on Interest Payments

Outstanding debt accrues interest over time, resulting in additional expenses. By paying off debt, you can save money that would otherwise be spent on interest payments.

3. Increasing Credit Score

Paying off debt in a timely manner positively impacts your credit score. A higher credit score opens doors to better financial opportunities, such as obtaining loans with favorable terms or qualifying for lower insurance premiums.

4. Improving Cash Flow

By paying off debt, you free up monthly cash flow. This extra money can be redirected towards other financial goals or used to cover unexpected expenses, providing greater financial flexibility.

II- Cons of Paying Off Debt

1. Missing out on Potential Investment Opportunities

While paying off debt is beneficial, it may mean missing out on potential investment opportunities. By focusing solely on debt repayment, you may forego the opportunity to grow your wealth through investments.

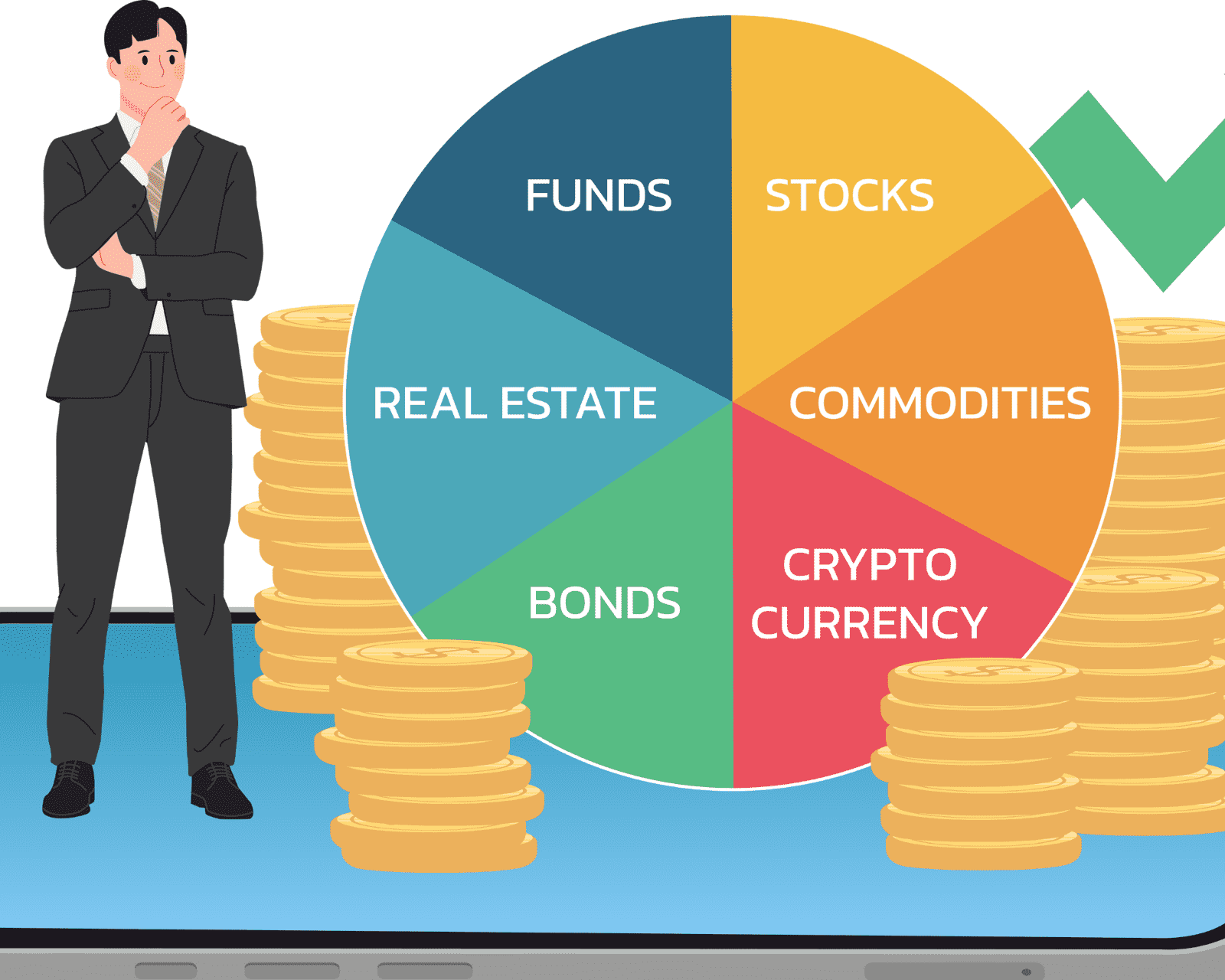

2. Limited Diversification

By prioritizing debt repayment, your investment portfolio may lack diversification. Investing in different asset classes is essential to manage risk effectively and achieve a balanced portfolio.

3. Limited Tax Benefits

Unlike investing in real estate, paying off debt often does not offer tax advantages. For example, you cannot deduct mortgage interest or depreciation expenses from your tax obligations.

III- Pros of Investing in Real Estate

1. Potential for Long-Term Appreciation

Real estate has a history of long-term appreciation, making it a potentially lucrative investment. Property values can increase over time, providing investors with substantial returns.

2. Generating Passive Income

Real estate investments can generate regular passive income through rental payments. This additional income stream can contribute to a more secure financial future.

3. Diversification of Investment Portfolio

Investing in real estate allows for greater diversification of your investment portfolio. This diversification helps spread risk and reduces reliance on a single asset class, enhancing overall stability.

4. Tax Advantages

Real estate investments offer various tax benefits. Deductions can be made on mortgage interest, property taxes, and even depreciation expenses, providing potential tax savings.

IV- Cons of Investing in Real Estate

1. Market Volatility and Potential Losses

Real estate markets can experience periods of volatility, and property values may fluctuate. As with any investment, there is a potential risk of loss, and investors must be prepared for market downturns.

2. Requirement for Significant Capital

Investing in real estate often requires a significant amount of capital upfront. This can make it less accessible for individuals with limited financial resources or those who are actively paying off debt.

3. Involvement in Property Management

Real estate investments typically require active involvement in property management. This includes tasks such as maintenance, tenant considerations, and potential legal issues. It is important to consider the time and effort required for effective property management.

4. Liquidity Challenges

Real estate investments are relatively illiquid compared to other investment options. Selling a property can be time-consuming and may involve additional costs, limiting access to your invested capital.

V- Factors to Consider

When deciding between paying off debt or investing in real estate, several factors should be considered:

- Current Debt Situation and Interest Rates: Assess the type of debt you have, the interest rates, and the overall impact on your financial well-being. High-interest debt may require immediate attention, while low-interest debt may allow for more flexibility.

- Available Investment Opportunities in Real Estate:

Research the local real estate market, rental demand, and potential returns on investment. Evaluate if there are opportunities that align with your financial goals and risk tolerance.

- Personal Financial Goals and Risk Tolerance:

Consider your long-term financial goals and the level of risk you are comfortable with. Real estate investments may align better with certain goals or risk profiles compared to paying off debt.

VI- Strategies to Consider

If you are torn between paying off debt and investing in real estate, there are strategies you can adopt to do both simultaneously:

1. Prioritize High-Interest Debt

Begin by paying off high-interest debt that consumes a significant portion of your income. This reduces interest expenses and improves your overall financial health.

2. Increase Income and Reduce Expenses

Look for ways to increase your income, such as taking on a side job or pursuing career advancement opportunities. Simultaneously, aim to reduce unnecessary expenses to free up more funds for both debt repayment and real estate investment.

3. Explore Real Estate Financing Options

If you decide to invest in real estate while balancing debt repayment, research financing options that align with your financial situation. This includes exploring mortgages, partnerships, or alternative financing methods.

Deciding between paying off debt or investing in real estate is a personal choice that depends on various factors. While paying off debt offers financial security and peace of mind, investing in real estate can provide long-term wealth accumulation and diversification. It is important

Pay Off Debt or Invest in Real Estate

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.