Living a Debt-Free Life: Tips for Achieving Financial Freedom

Living a debt-free life may seem like an impossible dream, especially in a world where credit cards and loans are readily available. However, with a little bit of planning and perseverance, it is possible to achieve financial freedom and live a debt-free life. In this article, we'll share some tips for living a debt-free life.

1. Create a budget

The first step in achieving financial freedom is to create a budget. A budget helps you track your income and expenses, ensuring that you don't overspend and accumulate debt. Start by tracking all of your expenses for a month, including rent/mortgage, utilities, food, transportation, and entertainment.

Use this information to create a budget that prioritizes your essential expenses and allows for some discretionary spending.

2. Pay off high-interest debt first

If you already have debt, focus on paying off your high-interest debt first. This may include credit card debt, personal loans, or other high-interest loans. Paying off high-interest debt first can help you save money in the long run and reduce your overall debt load.

3. Use cash instead of credit

Using cash instead of credit can help you stay within your budget and avoid accumulating additional debt. Consider using the envelope system, where you allocate a certain amount of cash for each category of expenses (e.g., groceries, entertainment) and only use that cash for those expenses.

4. Build an emergency fund

Building an emergency fund can help you avoid accumulating debt in the event of an unexpected expense or loss of income. Aim to save at least three to six months' worth of living expenses in an emergency fund.

5. Live below your means

Living below your means may mean making some sacrifices in the short term, but it can help you achieve financial freedom in the long run. This may include downsizing your home, driving an older car, or cutting back on discretionary expenses.

6. Avoid impulse purchases

Impulse purchases can quickly add up and lead to accumulating debt. Before making a purchase, take the time to consider whether it is a want or a need. Consider waiting 24 hours before making a purchase to give yourself time to think it over.

7. Find ways to increase your income

Increasing your income can help you pay off debt faster and achieve financial freedom. Consider taking on a side hustle, asking for a raise at work, or looking for a higher-paying job.

In conclusion, living a debt-free life may seem like an impossible dream, but with a little bit of planning and perseverance, it is possible to achieve financial freedom. By creating a budget, paying off high-interest debt first, using cash instead of credit, building an emergency fund, living below your means, avoiding impulse purchases, and finding ways to increase your income, you can take control of your finances and live a debt-free life.

Living a Debt-Free Life: Tips for Achieving Financial Freedom

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

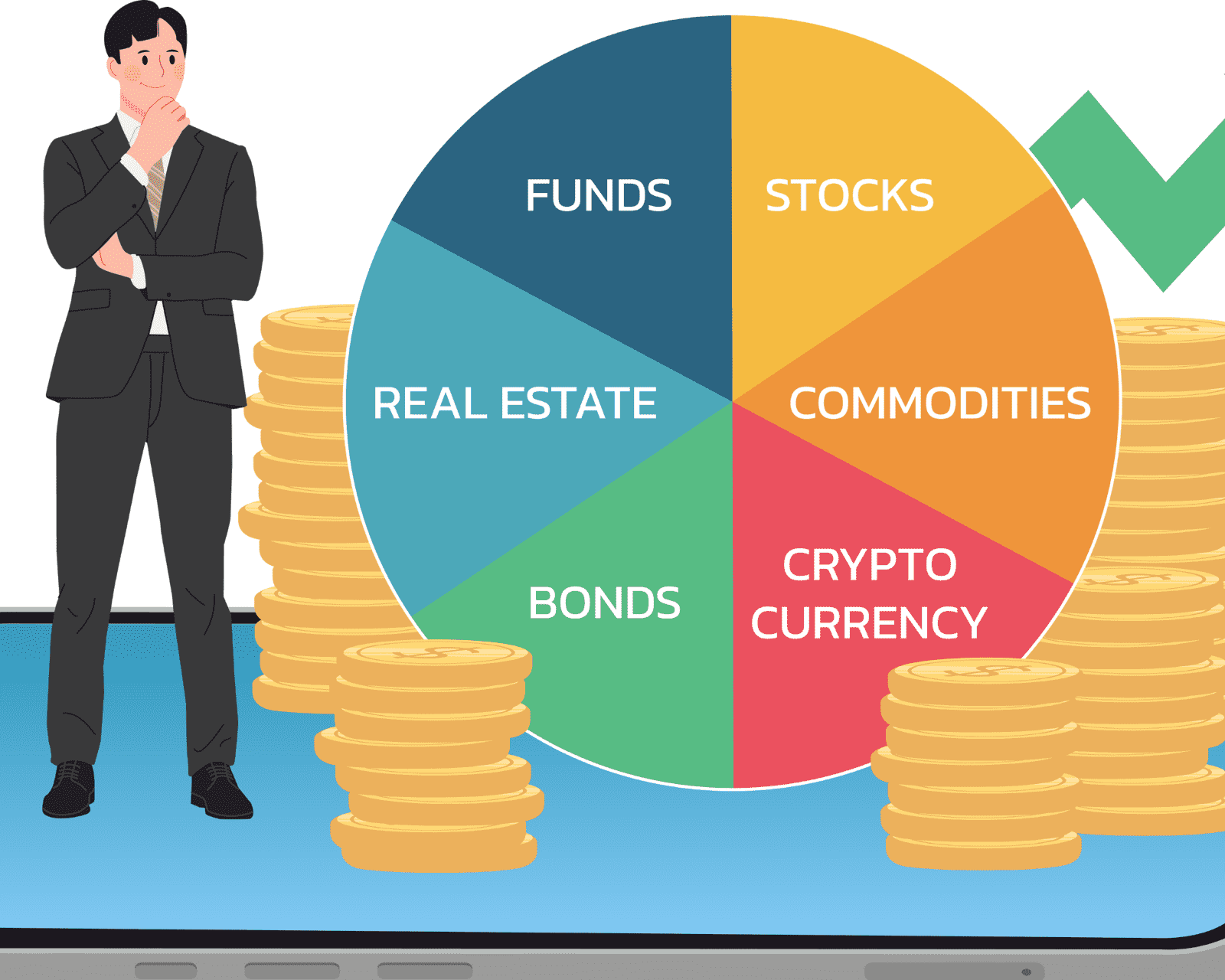

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.