Financial Habits of the Wealthy

When it comes to financial success, the habits and practices of the wealthy can provide valuable insights and lessons. Understanding the financial habits of those who have achieved significant wealth can help us learn from their experiences and apply their strategies to our own lives. In this article, we will explore the financial habits of the wealthy that are commonly observed among the wealthy and how they contribute to their success.

Before diving into the specific financial habits of the wealthy, it's important to define what we mean by wealth. Wealth goes beyond just the accumulation of money. It encompasses financial freedom, stability, and the ability to meet one's goals and desires without limitations. Developing good financial habits is crucial in achieving this state of affluence.

1- Goal Setting and Planning

One of the key habits of the wealthy is their ability to set clear financial goals and create a detailed plan to achieve them. They understand the importance of having a roadmap for their financial journey. By setting specific and measurable goals, they can track their progress and make adjustments along the way. Additionally, they establish budgets to effectively manage their finances and ensure they are allocating their resources in alignment with their goals.

2- Saving and Investing

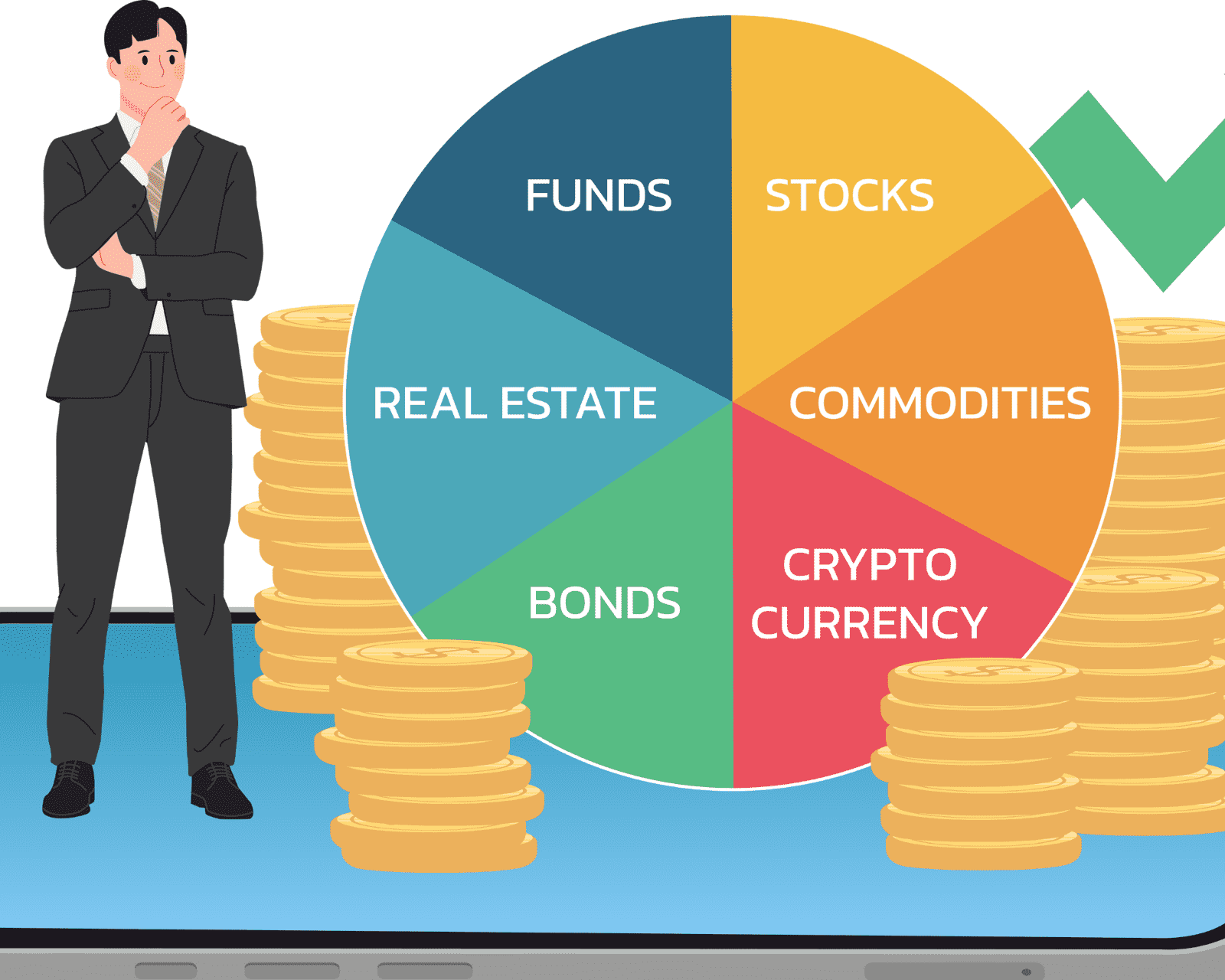

Another crucial financial habit of the wealthy is the ability to save and invest wisely. They prioritize saving a portion of their income and consistently contribute to their savings accounts or investment portfolios. They understand that wealth is not just about earning money but also about managing it effectively. The wealthy diversify their investments, spreading their risks across different asset classes such as stocks, real estate, and bonds. They also keep a long-term perspective, understanding that wealth creation is a gradual process.

3- Living Below Means

Living below their means is a common financial habit among the affluent. They have the discipline to avoid unnecessary and impulsive expenses. They prioritize their needs over their wants and practice frugality. By doing so, they have more resources available to contribute to their savings and investments, accelerating their wealth creation journey.

4- Continuous Learning and Financial Education

The wealthy understand the importance of continuous learning and financial education. They actively seek knowledge about financial markets, investment opportunities, and personal finance strategies. They read books, attend seminars, and take courses to expand their financial literacy. By staying informed and educated, they are better equipped to make informed decisions about their money.

5- Taking Calculated Risks

Financial success often requires the ability to take calculated risks. The wealthy understand that risk is an inherent part of wealth creation. They carefully assess potential risks before making significant financial decisions and weigh them against the potential rewards. By taking smart and calculated risks, they open themselves up to new opportunities for growth and financial success.

6- Surrounding Themselves with a Financially Savvy Network

Successful individuals understand the power of surrounding themselves with a network of financially savvy individuals. They actively seek out mentors and advisors who can provide guidance and support. By connecting with others who have achieved financial success, they can gain valuable insights, learn from their experiences, and access new opportunities.

7- Giving Back and Philanthropy

The wealthy often prioritize giving back to society through philanthropic activities. They understand the importance of making a positive impact on their communities and the world. Philanthropy not only provides them with a sense of fulfillment and purpose but also allows them to share their wealth and make a difference in the lives of others.

8- Discipline and Self-Control

Financial discipline and self-control are fundamental habits of the wealthy. They avoid impulsive purchases and unnecessary expenses. They have the ability to delay gratification and make sacrifices in the short-term for long-term financial success. By maintaining discipline and self-control, they are able to stick to their financial plans and make choices that align with their goals.

9- Embracing Mistakes and Learning from Failures

No one becomes wealthy without experiencing failures or making mistakes along the way. The wealthy understand this and embrace their failures as learning opportunities. They recognize that each mistake is a chance to refine their strategies and make better decisions in the future. They adapt and learn from their failures, continuously improving their financial decision-making.

10- Maintaining a Positive Mindset

A positive mindset is essential for financial success. The wealthy believe in the power of wealth creation and have a strong belief in their ability to achieve their goals. They practice gratitude and visualize their success, keeping themselves motivated and focused on their financial journey.

11- Balancing Work and Personal Life

Achieving work-life balance is crucial for long-term success and overall well-being. The wealthy understand the importance of maintaining a balance between work and personal life. They prioritize their physical and mental health, as well as their relationships, knowing that personal well-being is essential for sustainable success.

12- Seeking Professional Advice

The wealthy recognize the value of seeking professional advice when it comes to managing their finances. They consult financial advisors who can provide personalized guidance and strategies tailored to their individual goals. By leveraging the expertise of professionals, they can make more informed financial decisions and optimize their wealth creation efforts.

13- Maintaining Healthy Credit Habits

Good credit habits are essential for financial stability and access to favorable financial opportunities. The wealthy manage their credit cards responsibly, paying their bills on time, and keeping their credit scores high. This allows them to leverage their creditworthiness when required and take advantage of favorable financing options.

In conclusion, the financial habits of the wealthy provide valuable lessons for anyone looking to achieve financial success. By adopting these habits, such as setting clear goals, saving and investing wisely, living below their means, continuously expanding their financial knowledge, and maintaining discipline and self-control, individuals can take control of their financial future. It is through a combination of mindset, strategic planning, and diligent execution that wealth creation becomes a reality.

5 Unique FAQs

1. How can I start building wealth if I have limited income?

- Even with limited income, you can start building wealth by saving consistently and living within your means. Establish clear financial goals, create a budget, and explore investment opportunities that align with your risk tolerance and financial capabilities.

2. What is the importance of diversifying investments?

- Diversifying your investments helps spread the risk. By allocating your resources across different asset classes, you reduce the impact of any one investment's performance on your overall portfolio. This can help protect your wealth from unpredictable market fluctuations.

3. Can I become wealthy without taking risks?

- While some wealth can be accumulated through conservative approaches, taking calculated risks is often necessary for substantial financial growth. Without taking risks, it can be challenging to uncover new opportunities and maximize your potential for wealth creation.

4. How can I practice financial discipline and avoid impulsive purchases?

- To practice financial discipline, create a budget and stick to it. Before making any purchase, assess whether it aligns with your financial goals and priorities. Develop a habit of delaying gratification and consider the long-term impact of your financial decisions.

5. What are some recommended ways to give back without significant financial resources?

- Giving back is not limited to monetary contributions. Volunteering your time and skills to charitable organizations can make a significant impact. You can also raise awareness about causes that are important to you through social media or

Financial Habits of the Wealthy

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.