Vacation Property Investment Loans: What you should know

Vacation property investment loans are a type of loan that investors can use to purchase a vacation home or rental property. These loans are designed specifically for real estate investors and offer a range of benefits, including flexible terms, competitive interest rates, and low down payments. Here's what you need to know about vacation property investment loans.

I- Types of Vacation Property Investment Loans

There are two main types of vacation property investment loans: conventional and government-backed. Conventional loans are offered by private lenders and typically require a higher credit score and down payment.

Government-backed loans, such as FHA and VA loans, are backed by the government and have more flexible credit and down payment requirements.

II- Benefits of Vacation Property Investment Loans

Vacation property investment loans offer several benefits for real estate investors. First, they provide flexible terms, allowing investors to choose a loan that fits their unique financial situation. Second, they offer competitive interest rates, which can help reduce the overall cost of borrowing. Finally, they require lower down payments than traditional mortgages, making it easier for investors to purchase a property with less money upfront.

III- Challenges of Vacation Property Investment Loans

While vacation property investment loans offer a range of benefits, there are also some challenges to consider. One of the main challenges is that they can be harder to qualify for than traditional mortgages. Investors may need to have a higher credit score and a larger down payment to be approved for a loan. Additionally, lenders may require more documentation and proof of income to ensure that the investor is financially stable.

IV- Tips for Getting a Vacation Property Investment Loan

If you're interested in getting a vacation property investment loan, there are a few tips to keep in mind. First, shop around to find the best loan terms and interest rates. Second, work on improving your credit score and financial stability before applying for a loan. Finally, be prepared to provide documentation and proof of income to show lenders that you're a responsible borrower.

In conclusion, vacation property investment loans can be a great way for real estate investors to purchase a vacation home or rental property. While they offer several benefits, they also come with some challenges. By understanding the different types of loans, benefits, challenges, and tips for getting approved, you can make an informed decision about whether a vacation property investment loan is right for you.

Vacation Property Investment Loans: What you should know

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

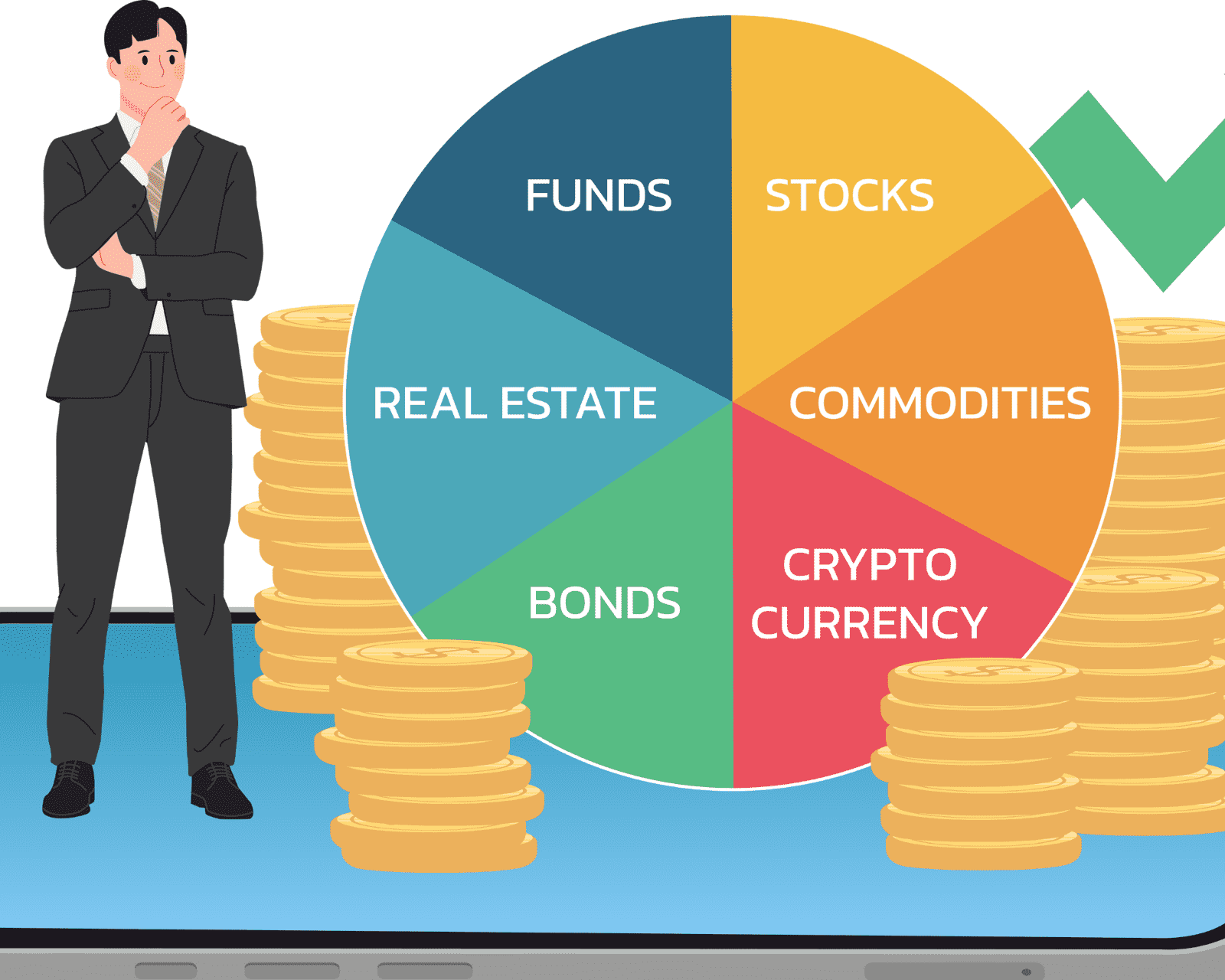

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.