Is it Worth it to Get a Personal Loan to Pay Off Debt?

When faced with overwhelming debt, individuals often explore different options to ease their financial burden. One option is to consider using a personal loan to pay off existing debt. While a personal loan can offer certain advantages, it is essential to thoroughly evaluate its worthiness before proceeding. In this article, we will analyze the pros and cons of obtaining a personal loan to pay off debt, helping you make an informed decision.

I- Pros of Using a Personal Loan

1. Consolidating Debt

One of the primary benefits of using a personal loan to pay off debt is consolidation. Instead of managing multiple monthly payments, a personal loan allows you to combine all your debts into a single loan with a fixed interest rate and a defined repayment term. This simplifies your financial obligations and can potentially lower your overall monthly payment.

2. Lower Interest Rates

Personal loans often come with lower interest rates compared to credit cards or other forms of unsecured debt. By taking out a personal loan to pay off high-interest debt, you can potentially save on interest charges over time. Lower interest rates allow more of your payment to go toward reducing the principal amount, enabling you to become debt-free faster.

3. Fixed Repayment Term

Personal loans typically come with a fixed repayment term, meaning you have a specific timeframe to pay off the loan. This provides a disciplined approach to debt repayment and allows you to create a structured plan to become debt-free. The fixed term also prevents you from falling into the trap of making minimum payments, which can prolong debt repayment.

4. Improve Credit Score

When you take out a personal loan and repay it responsibly, it can positively impact your credit score. By paying off existing debt with a personal loan, you reduce your debt utilization ratio and demonstrate to creditors that you can manage credit responsibly. This may lead to an improvement in your credit score over time, potentially opening up better financial opportunities in the future.

II- Cons of Using a Personal Loan

1. Additional Debt Burden

Obtaining a personal loan to pay off debt means taking on a new financial obligation. While this consolidates your existing debts, it increases your overall debt burden. It is crucial to carefully analyze whether you can comfortably manage the monthly payments on your new personal loan without further straining your financial situation.

2. Qualification Requirements

Qualifying for a personal loan may require meeting specific eligibility criteria, such as having a good credit score, stable income, and a low debt-to-income ratio. If your financial circumstances do not meet the necessary requirements, obtaining a personal loan may be challenging or result in high-interest rates that negate the potential benefits.

3. Fees and Charges

Personal loans may come with various fees and charges, such as origination fees, prepayment penalties, and annual fees. These additional costs can add up and impact the overall cost-effectiveness of using a personal loan to pay off debt. It is essential to carefully review the loan terms and calculate the total cost of borrowing before making a decision.

4. Temptation to Accumulate More Debt

By paying off existing debt with a personal loan, there is a risk of falling back into old spending habits and accumulating new debt. This can result in a worsening financial situation and negate the benefits of consolidating debt. It requires discipline and commitment to avoid further debt and make the most of the opportunity to become financially stable.

III- Factors to Consider

Before deciding to obtain a personal loan to pay off debt, consider the following factors:

- Interest Rates

Compare the interest rates on your existing debt with the rates offered on personal loans. If the personal loan rates are significantly lower, it may be worth considering consolidation.

- Total Cost of Borrowing

Evaluate the total cost of borrowing, including any fees or charges associated with a personal loan. Calculate the savings in interest payments to determine if the cost-effectiveness outweighs the additional expenses.

- Financial Situation

Assess your current financial situation, including your income stability and ability to meet the new loan's monthly payments. Ensure the loan does not cause further strain on your finances.

- Discipline and Financial Management

Examine your spending habits and financial discipline to prevent the accumulation of new debt. Consider whether you have the necessary discipline to make the most of the consolidation opportunity.

Utilizing a personal loan to pay off debt can be a viable option for many individuals looking to streamline their financial obligations and potentially save on interest payments. However, it is important to carefully weigh the pros and cons before making a decision. Assess your financial situation, calculate the cost-effectiveness, and evaluate your ability to manage the new loan responsibly. By considering all these factors, you can make an informed decision that aligns with your unique circumstances and helps you achieve your financial goals.

Is it Worth it to Get a Personal Loan to Pay Off Debt?

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

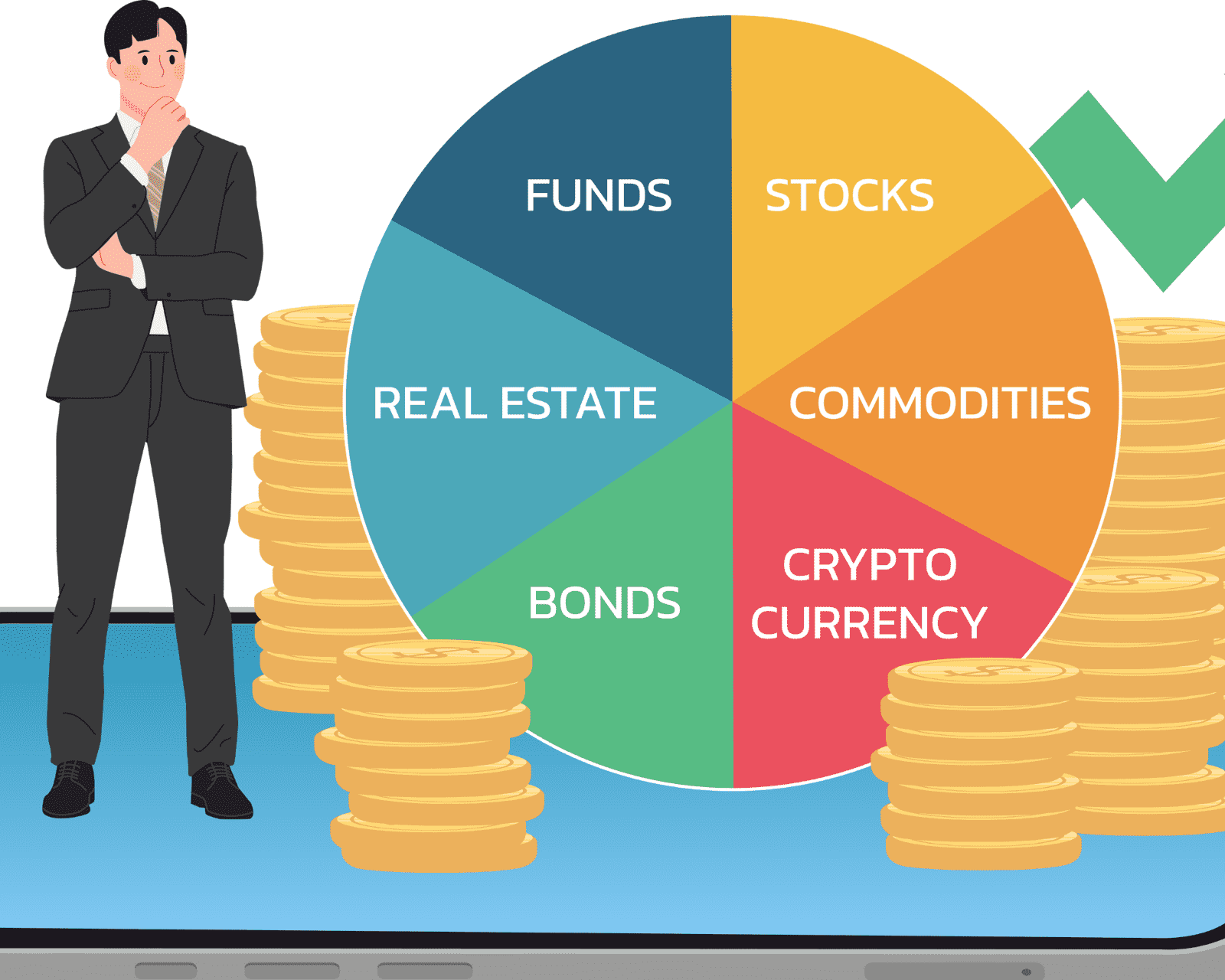

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.