When does the Australian Real Estate Market turn around?

As the real estate market in Australia experiences a decline, experts hold differing opinions regarding its future. While some believe that the market will soon bounce back, others maintain that it is not an entirely positive situation due to many challenges.

One issue that may hold back the real estate market's recovery is the declining credit capacity of Australians. Financial experts warn that high interest rates and the appearance of "soft loans" may affect lending activity, which could prolong the market's recovery or cause it to decline further.

Ben Jarman of JP Morgan investment bank is optimistic about the market's future and expects property prices to stabilize due to a peaking interest rate and favorable government policies. Still, he recognizes that Australia's credit capacity remains significantly lower than before the pandemic, making a rate cut a significant factor in the market's future.

Moreover, the rising unemployment rate, unfavorable economic growth, and the prospect of slow economic growth may worsen the credit capacity problem. These factors are likely to limit new borrowers' ability to repay their loans, affecting the real estate market.

Another challenge affecting the real estate market is the increase in the number of homes for sale in Australia. Although this may be a positive development for home buyers, it is relatively significant considering that the market's purchasing power has not increased, threatening to extinguish any new positive trend in the housing market.

The recent increase in real estate listings below the long-term average is also the reason why the market has not adjusted more strongly than expected. Although there has been a slight increase in property prices, the sentiment remained cautious, affecting the market's total rebound.

The recent increase in consumer sentiment index in Westpac Bank suggests that market sentiment needs to improve significantly for the market to return to its mean, and such a return may be some way off.

The real estate market in Australia is experiencing a decline, which is likely to limit home buyers' choices. Although some analysts are cautiously optimistic and expect that the market will recover in the coming months or years, there are many challenges that must be overcome before this can occur. These include the declining credit capacity of Australians, the increase in the number of homes for sale and cautious sentiment. Therefore, it is essential to focus on the big picture instead of guessing the market trends, which may lead to bad decisions.

When does the Australian Real Estate Market turn around?

Luxury Real Estate in Lisbon: Prices Climb to Second Highest Globally

Luxury Real Estate in Lisbon: Prices Climb to Second Highest Globally

Luxury real estate in Lisbon are experiencing a remarkable surge in prices, now ranking as the second highest in the world. This trend highlights the city's growing appeal among affluent buyers and investors.

Spain Real Estate Prices Surge 11.7% in Q2

Spain Real Estate Prices Surge 11.7% in Q2

Discover the latest trends as Spain real estate market experiences its largest growth since 2007, with prices soaring in the second quarter.

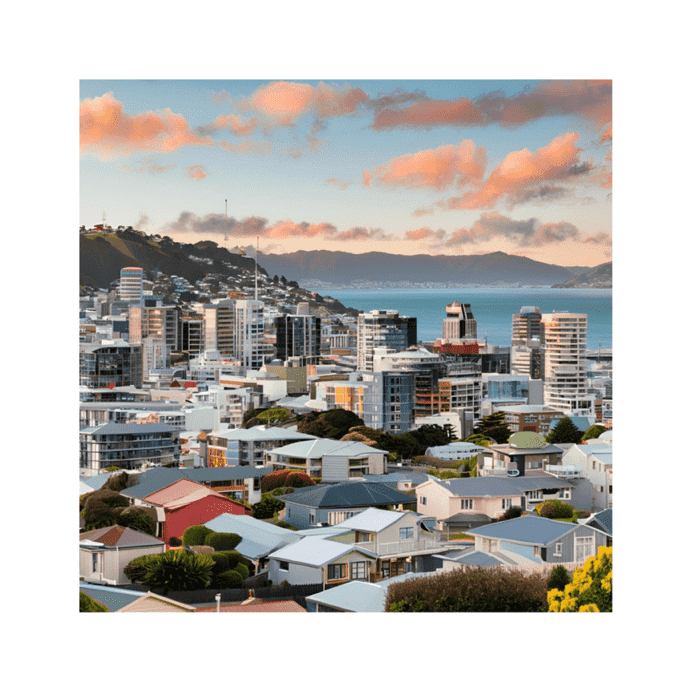

New Zealand Real Estate: Rentals Surge as Prices Drop

New Zealand Real Estate: Rentals Surge as Prices Drop

Explore the latest trends in the New Zealand real estate market, where rental listings soar amid declining property prices.

UK Real Estate Market: Discounts on Short Lease Properties

UK Real Estate Market: Discounts on Short Lease Properties

Short lease properties in the UK offer discounts averaging £36,000, raising vital questions about their market viability and future trends.

Professional Landlords Turn to Multi-Unit Freehold Blocks: A Growing Trend in Real Estate Investing

Professional Landlords Turn to Multi-Unit Freehold Blocks: A Growing Trend in Real Estate Investing

Discover why professional landlords are increasingly investing in Multi-Unit Freehold Blocks, with a 14% rise in interest for 2024.