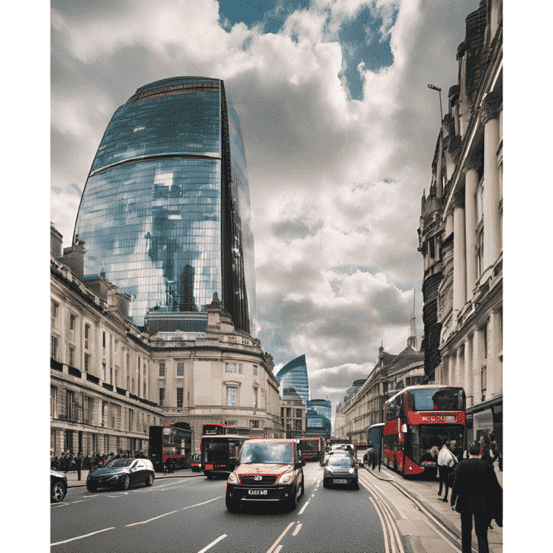

UK Real Estate Market: Buy-to-Let Decline Boosts Sales

Explore how the decline in buy-to-let properties is driving a surge in home sales within the UK real estate market. Insights and analysis await.

The UK real estate market is currently experiencing a remarkable surge in activity, with a staggering 26% increase in homes undergoing the buying process compared to the same period last year, according to research conducted by Zoopla. This translates to an impressive 306,000 properties changing hands, collectively valued at a whopping £133 billion. The driving forces behind this phenomenon appear to be a confluence of rising incomes and historically low mortgage rates.

However, an intriguing twist in this narrative is the apparent decline in confidence among buy-to-let investors, leading to a notable exodus of landlords from the market, as they offload their housing stock. As we look ahead, projections indicate a modest 2% increase in property prices for 2024, alongside an anticipated 1.1 million transactions. Notably, house prices are expected to rise by 2% over the course of the year.

In regions deemed more affordable, the upward trajectory of house prices is particularly pronounced, with the North-East, Yorkshire & Humberside, North-West, Scotland, and Northern Ireland all experiencing above-average growth rates of 2%, 2%, 2.3%, 2.4%, and a remarkable 5.6%, respectively. In stark contrast, Eastern England and the South-East are witnessing slight declines, with prices dipping by -0.3% and -0.1%, respectively.

For first-time buyers, the current landscape is somewhat favorable, as they are exempt from stamp duty on properties valued up to £425,000, and only incur partial stamp duty on homes priced up to £625,000 (applicable in England and Northern Ireland). Presently, a commendable 80% of first-time buyers are enjoying a stamp duty-free experience, while 14% are only partially liable. However, this advantageous support is set to expire in April 2025, unless the forthcoming Budget introduces a reversal. Should the previous thresholds be reinstated, an additional 20% of buyers would find themselves liable for stamp duty, with a further 14% facing partial obligations.

The UK real estate market is a dynamic and multifaceted arena, where economic factors, investor sentiment, and governmental policies intertwine to shape the experiences of buyers and sellers alike.

UK Real Estate Market: Buy-to-Let Decline Boosts Sales

Greece: Europe’s Fourth Cheapest Real Estate Market

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy investors seeking value and opportunity.

Surge in Scottish Home Sales: UK Real Estate Update

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth in years, signaling a vibrant market.

Spain: A Leading Market in European Real Estate

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail, logistics, and hotel sectors for strategic growth.

Greece Real Estate Market: Rise of Serviced Apartments

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Home Prices Hit by Climate Change, J.P. Morgan Warns

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.