Top 5 Money Saving Rules to follow in Your 20s

Saving and investing when you're in your 20s doesn't seem realistic. Because you always think there will be many more years to do with this. But an early start will pay off more than you think.

At the age of 20, you start entering the workforce. Your salary is usually average or low. You are still feeling financially independent for the first time in your life. Most people's instinct is to spend their first few years' wages on things and travel which brings great feeling.

It's very likely that the amount of money you save in your first year of working will be a fraction of what you could save in your 30s. But early saving habits will keep you have a financial free as you age and your income grows. Most importantly, don't underestimate the power of compounding, saving early is beneficial.

Therefore, it is reasonable to start saving from the age of 20. Here are Top 5 Money Saving Rules to follow in Your 20s to get you started.

1- Save 10-20% of Your Salary

When you calculate your expenses, let's assume only 80-90% salary.

The best way to make sure you save and invest enough is to prepare your investments in advance such as scheduling a systematic investment plan at the beginning of the month, investing in savings fund, etc.

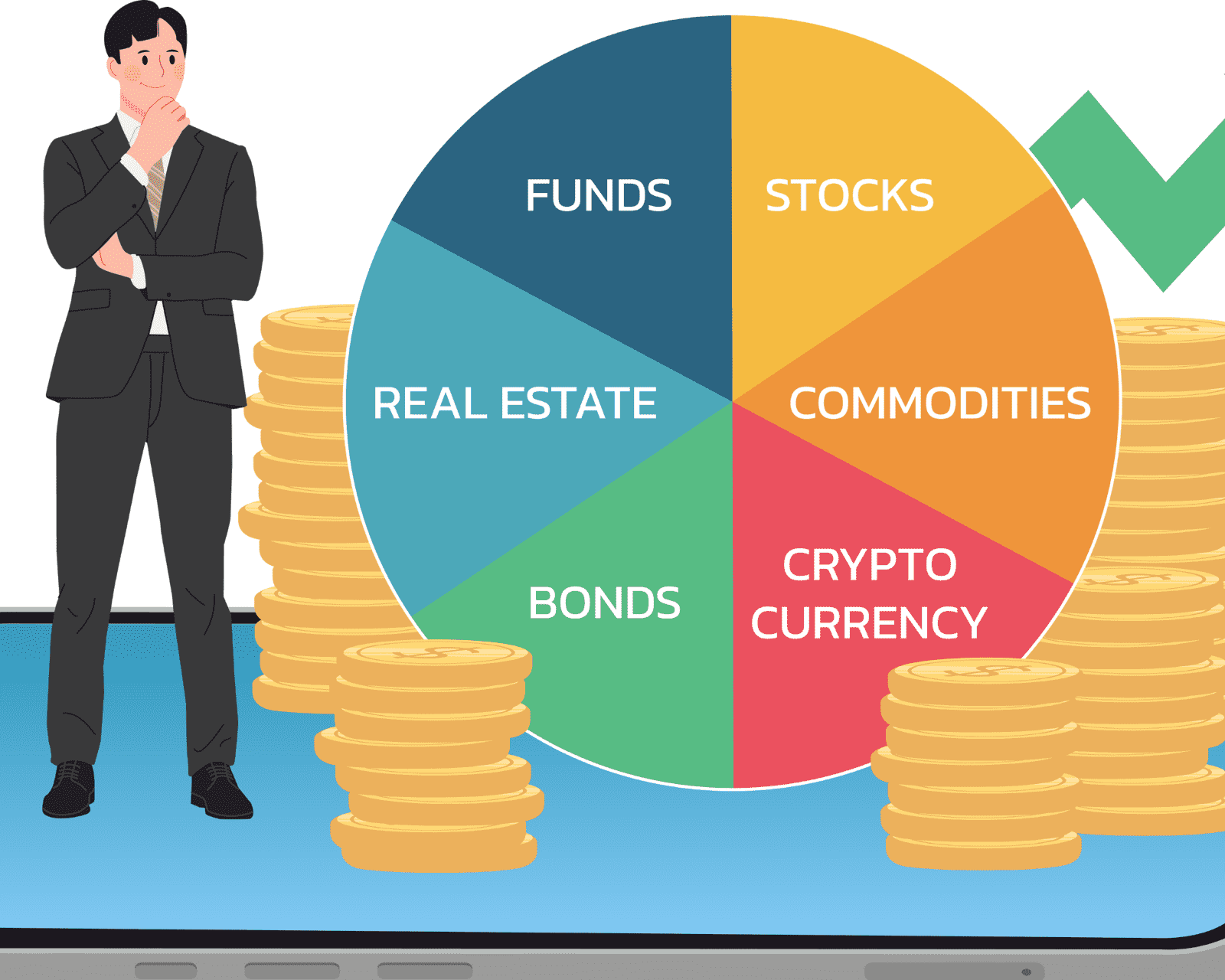

2- Investing Your Money

If you do not invest, you will lose money because the price of goods is increasing day by day.

The most important thing is not to put money in a savings account. In addition to what you need to spend immediately, start investing the rest of the money. The idea that money in a savings account is safe isn't so true these days. Because prices are escalating day by day, the bank's interest rates are not too high.

3- Use Goals to Save Money

Do you want to take a travel trip to Europe next year? Buy new iPhone line?

Set up a separate fund for these major expenses. Using big goals to delay gratification is a great way to build the habit of saving.

4- Educate Yourself about Money Management

If you didn't learn how to manage your personal finances at school, let’s educate yourself about money management as soon as better.

You can read a few books on how finance, the stock market and asset allocation work. This investment in education will give you the right principles to start your savings and investing journey.

5- Forgive Yourself for Making Financial Mistakes

You will make mistakes in saving, investing and spending. You may invest in something because other people are doing it, spending more than you intended, or you are lazy and don't start saving. It's all okay. Let’s forgive yourself for making financial mistakes.

It is important that you learn from those financial mistakes and correct them. Remember it's never too late or too early to start saving and investing.

Remember that saving will sometimes make your life boring. It's like healthcare, you need to work on it daily.

Therefore, as you begin your career and personal finance journey, build good money habits from the start, the sooner the better.

Top 5 Money Saving Rules to follow in Your 20s

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.