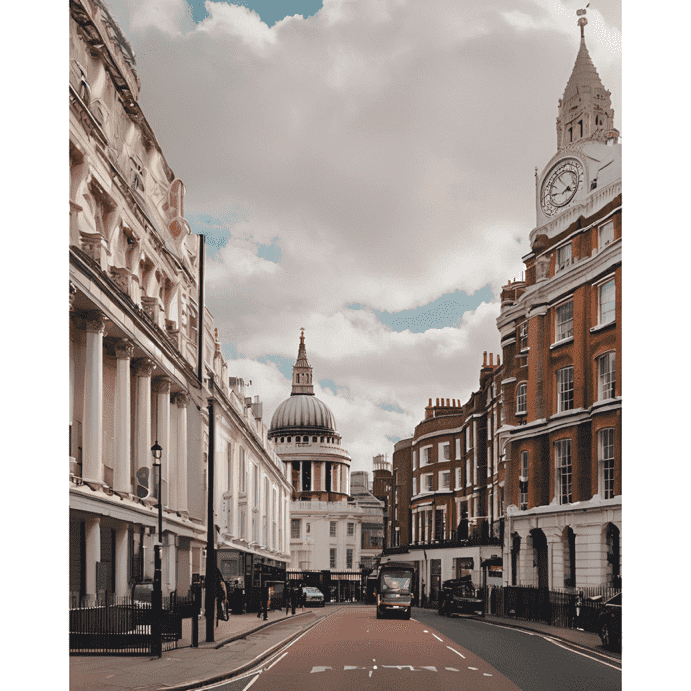

London Rents Drop: UK Real Estate Market Trends

Explore the latest trends in the UK real estate market as London rents fall for the third consecutive quarter. Key insights and analysis provided.

In a rather intriguing turn of events, the rental landscape in London has experienced a notable decline, with rents decreasing each quarter throughout 2024. This trend suggests a significant cooling of the market, as revealed by data from the flatshare platform SpareRoom. However, the East Central region of London has defied this downward trajectory, boasting a remarkable increase of 4%. Meanwhile, the North and West regions have remained stagnant, with no change in rental prices (0%), while the South West has seen a slight dip of 1%.

Despite these fluctuations, it is worth noting that rents in London have still experienced a modest annual increase of 1% compared to the third quarter of 2023. The postcodes that have witnessed the most substantial declines include W8, Holland Park, and N2, East Finchley, both plummeting by an astonishing 11%. Following closely are SW7, encompassing South Kensington and Knightsbridge, along with SW3, Chelsea, both of which have seen a decrease of 7%.

For those on the hunt for more affordable accommodations, the most budget-friendly areas in London, based on monthly room rent, are E4, Chingford (£777), E6, East Ham (£778), and E7, Forest Gate (£785). Interestingly, outside the capital, Edinburgh has emerged as the most expensive city for renting, with an average room costing a staggering £920 per month. This data paints a vivid picture of the current rental dynamics, highlighting both the challenges and opportunities present in the ever-evolving UK real estate market.

London Rents Drop: UK Real Estate Market Trends

Greece: Europe’s Fourth Cheapest Real Estate Market

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy investors seeking value and opportunity.

Surge in Scottish Home Sales: UK Real Estate Update

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth in years, signaling a vibrant market.

Spain: A Leading Market in European Real Estate

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail, logistics, and hotel sectors for strategic growth.

Greece Real Estate Market: Rise of Serviced Apartments

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Home Prices Hit by Climate Change, J.P. Morgan Warns

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.