Investment Influx: Global Players Bet Big on Japan’s Booming Hotel Industry

In recent years, Japan's hotel industry has experienced an influx of foreign investors, who are pouring substantial amounts of money into this thriving sector. The rapid recovery of the tourism industry and the country's highest inflation rate in four decades have created ideal conditions for lucrative investments. Notably, the year 2023 has witnessed an unprecedented surge in foreign investments, surpassing the total amount invested in 2022.

Leading global investors, including financial giants such as Goldman Sachs, KKR, and Blackstone, have collectively invested a staggering $2 billion in hotel deals in Japan this year alone. This remarkable figure highlights the attractiveness of the hotel industry to foreign investors, surpassing investments made in any other sector within the Asian commercial real estate market. By comparison, foreign investors contributed $1.4 billion to Japan's hotel industry throughout the entire year of 2022.

Strong demand for tourist accommodations coupled with soaring prices in Japan have created an environment universally appealing to investors. Unlike other real estate segments, such as apartments, offices, or warehouses, hotels possess the advantage of being able to adjust room rates in real-time, thereby mitigating the impact of inflation. This flexibility makes hotel investments far more appealing as compared to other types of property investments.

Furthermore, the depreciating value of the yen has further enhanced Japan's attractiveness to tourists and investors from countries with stronger currencies. As a result, visitors to Japan are spending more money compared to pre-pandemic levels. Recent data from the Japan Tourism Agency reveals that a significant portion of this expenditure is allocated towards accommodation, food, and entertainment expenses.

Japan's core consumer price index, excluding energy and fresh food prices, is experiencing its most robust growth since 1981, signaling the country's transition from a prolonged period of deflation. These favorable economic factors indicate that the hotel sector in Japan has tremendous room for expansion and growth.

Despite the ongoing recovery of the tourism industry, both visitor numbers and hotel occupancy remain below the levels recorded in 2019. However, it is noteworthy that the average daily room rate in the first half of this year was roughly 16% higher than that of the second half of 2019, according to real estate data provider CoStar. This data suggests that the recovery of the hotel industry is progressing steadily.

Industry experts have also expressed their confidence in the hotel sector, with leading asset manager Blackstone reaffirming hotels as their primary acquisition priority. Blackstone has recently resumed purchasing deals after generating an impressive $4.5 billion from property sales within Japan last year.

In a significant transaction last month, a group of investors, including Goldman Sachs Asset Management, Abu Dhabi Investment Authority, and SC Capital Partners, purchased a portfolio of 27 hotels for approximately $900 million. These stunning hotels are located in popular tourist destinations throughout Japan, boasting a total of 7,124 rooms. The acquisition offers a rare opportunity for investors to own one of the largest and most prestigious hotel portfolios in the country.

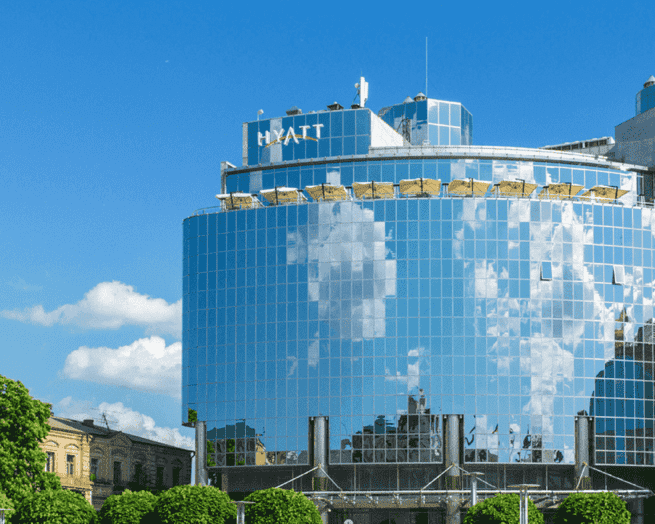

Continuing this upward trajectory, the Canadian investment fund BentallGreenOak recently finalized the acquisition of the renowned Ritz-Carlton hotel in Fukuoka city. Likewise, KKR and Gaw Capital announced their agreement to acquire the Tokyo Hyatt Regency, a luxurious hotel situated in central Tokyo. Although the transaction price was undisclosed, Japanese media estimated its worth to be around 100 billion yen ($688 million) based on previous sale discussions.

In spite of the significant growth experienced by Japan's hospitality industry, challenges persist, primarily the worsening labor shortage. This issue has the potential to hinder the operational efficiency and profitability of hotels across the country, as indicated by real estate services firm Savills.

As Japanese real estate remains scarce for sale, investors face fierce competition in the market. The MSCI Real Assets report indicates that hotel investment spending in Japan by foreign investors has grown at the fastest pace in nearly a decade, accounting for the most substantial share of hotel transactions since 2014.

Clients from Singapore, represented by Zoe Ward, CEO of brokerage Japan Property Central KK, currently seek to invest up to $100 million in a hotel catering to business guests. This demand from foreign investors demonstrates the vast potential for further growth in the Japanese hotel industry.

To conclude, Japan's hotel sector has become a hotspot for global investors amid the rapid recovery of the tourism industry and the country's economic growth. The significant investments made by renowned financial institutions underscore the sector's appeal and potential for expansion. While challenges persist, such as the labor shortage, the Japanese hotel industry is poised for further growth and success.

Investment Influx: Global Players Bet Big on Japan’s Booming Hotel Industry

Greece: Europe’s Fourth Cheapest Real Estate Market

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy investors seeking value and opportunity.

Surge in Scottish Home Sales: UK Real Estate Update

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth in years, signaling a vibrant market.

Spain: A Leading Market in European Real Estate

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail, logistics, and hotel sectors for strategic growth.

Greece Real Estate Market: Rise of Serviced Apartments

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Home Prices Hit by Climate Change, J.P. Morgan Warns

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.