How To Protect Your Money Against Inflation?

Inflation can be a very scary thing for anyone who wants to save their hard-earned money. It can eat away at your buying power and make it difficult to purchase the things that you once could afford. This is why it's so important to protect your money against inflation.

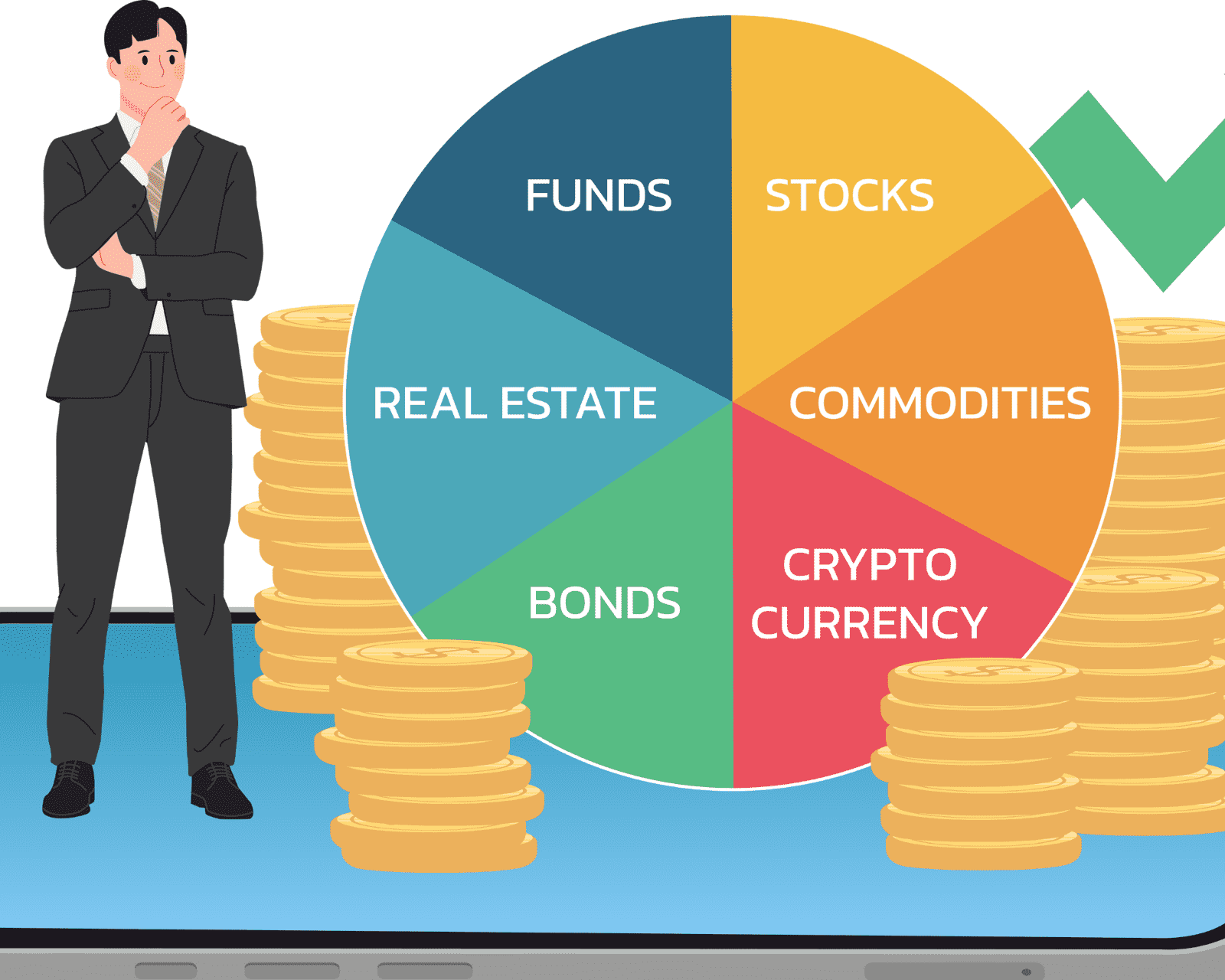

One way to do this is to invest in assets that have a tendency to increase in value over time. This could include things like real estate, stocks, or even precious metals like gold or silver. These assets tend to hold their value well during times of inflation and can even appreciate in value.

Another way to protect your money against inflation is to invest in inflation-indexed bonds. These bonds are specifically designed to keep pace with inflation, making them a smart choice for anyone worried about their buying power. They're also often government-backed, making them a relatively safe investment option.

Finally, it's important to keep an eye on the inflation rate itself. By monitoring trends in the inflation rate, you can predict potential changes in your buying power and make adjustments to your investments accordingly. For example, if you expect inflation to go up in the next few years, you might consider moving some of your money into inflation-protected assets.

Overall, protecting your money against inflation requires both vigilance and foresight. By investing in smart, long-term assets and tracking inflation trends, you can help safeguard your financial future. Don't let inflation eat away at your hard-earned savings - take action today to keep your money safe and secure.

How To Protect Your Money Against Inflation?

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.