How To Live A Debt-Free Lifestyle: Top 5 Tips

Living a debt-free lifestyle is an ambitious and rewarding goal that can be achieved by anyone with dedication, discipline, and some smart financial planning. It is a lifestyle in which you are in control of your finances and not living paycheck to paycheck. With some simple changes to your spending habits and a commitment to living within your means, you too can experience the liberating sensation of being debt-free.

1. Set a budget and stick to it

The first step towards living a debt-free lifestyle is to make a budget that details your monthly income and expenses. This will help you understand how much money you have available and where it goes each month. You can use a simple spreadsheet or budgeting app to help you track your expenses and keep your finances in check.

2. Avoid unnecessary spending

Living a debt-free lifestyle requires some sacrifices when it comes to spending. Learn to say no to impulse purchases and make a habit of waiting for sales and discounts when buying things you need. Avoid eating out or buying expensive coffee too often, as these are expenses that can add up quickly.

3. Prioritize your debt payments

If you have existing debt, make a plan to pay it off as quickly as possible which is a clever way for living a debt-free lifestyle.

Prioritize your debts by paying off those with the highest interest rates first. You can also consider consolidating your debts into a single payment to make it more manageable and cost-efficient.

4. Build an emergency fund

Creating an emergency fund can help you to avoid getting into debt in the first place. Aim to save enough money to cover three to six months of your essential living expenses, in case of unexpected expenses or emergencies.

5. Track your progress

Keep track of your progress and celebrate your milestones throughout your journey towards living a debt-free lifestyle. This will help motivate you to continue with your efforts and work towards financial freedom.

In conclusion, living a debt-free lifestyle is achievable by anyone with a bit of discipline, budgeting, and sensible spending habits. It may take some time and effort, but the peace of mind, financial security, and freedom that come along with being debt-free are well worth the effort. Start today and journey towards your financial freedom.

How To Live A Debt-Free Lifestyle: Top 5 Tips

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

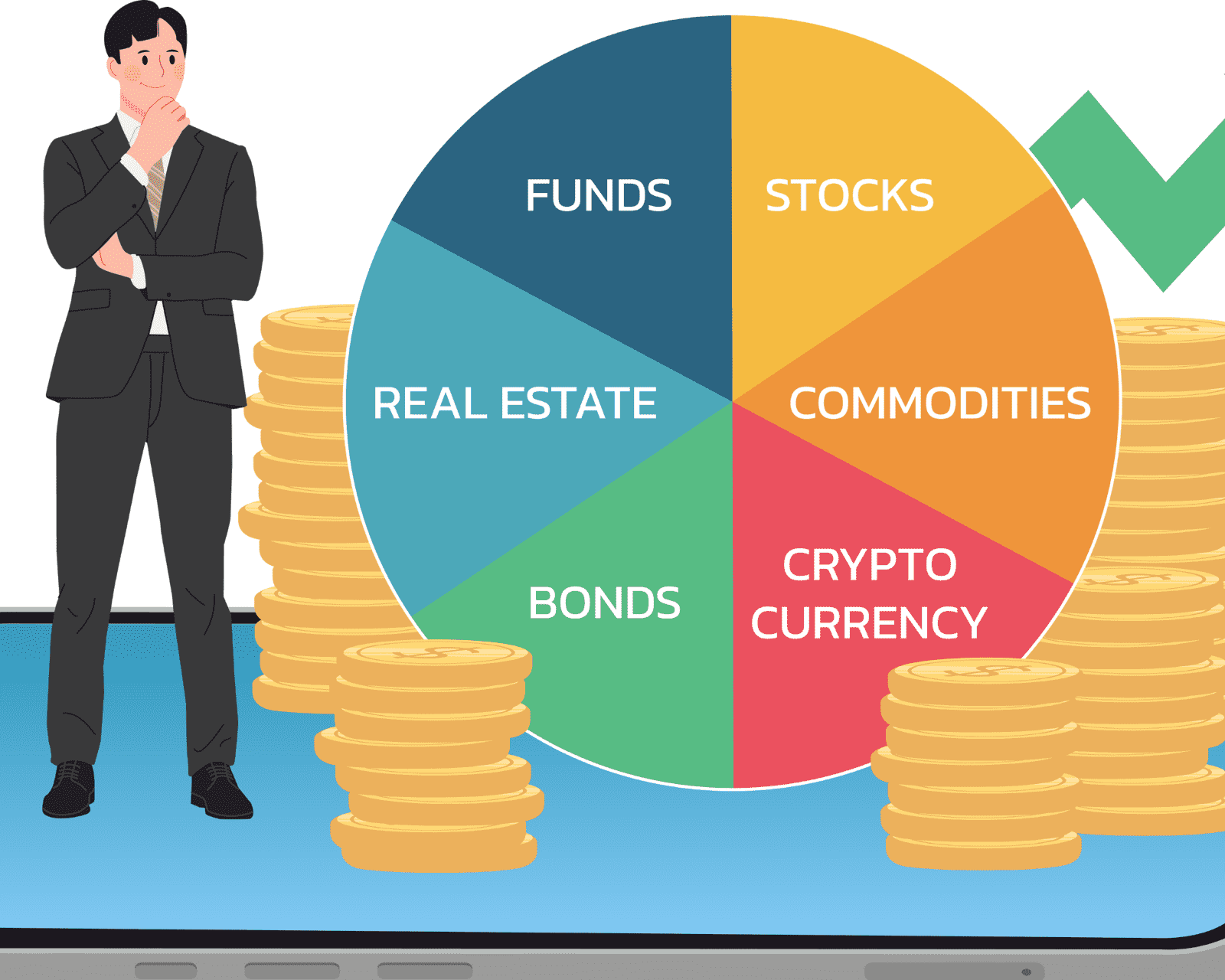

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.