How to Get Out of Debt with No MONEY and Bad Credit: 6 Tips

Debt can be a stressful and overwhelming situation. It can be even more difficult when you have no money and bad credit. However, there are still steps you can take to get out of debt. Here are 6 tips to help you reduce your debt with no money and bad credit.

1. Set Up a Budget

Creating a budget is one of the most important steps for getting out of debt with no money. Start by figuring out how much money you have coming in each month. Subtract all necessary expenses like rent, utilities, food, and transportation costs. Use the rest of the money to make payments to your creditors.

2. Negotiate with Your Creditors

If you’ve fallen behind on payments, chances are your creditors will be willing to work with you. Negotiate with them to lower your balance or interest rate and come up with a payment plan you can stick with.

3. Talk to a Professional

Speaking with a financial advisor or credit counselor can be helpful. They will help you develop a plan to manage your debt and improve your credit score.

4. Consider Debt Consolidation

Debt consolidation is a great option if you’re struggling to keep track of multiple debts.

You can apply for a loan to pay off all your debt, and then make one monthly payment. Make sure to research the best debt consolidation options for your situation.

5. Consider Other Options

If debt consolidation isn’t an option, you may want to look into debt relief or debt settlement companies. These companies help negotiate with creditors to lower your debt. They can also offer advice on how to manage your debt.

6. Stay Positive

Developing a plan and sticking to it can be hard, but don’t give up! With the right strategies and a positive attitude, you can get out of debt despite having no money and bad credit.

How to Get Out of Debt with No MONEY and Bad Credit: 6 Tips

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

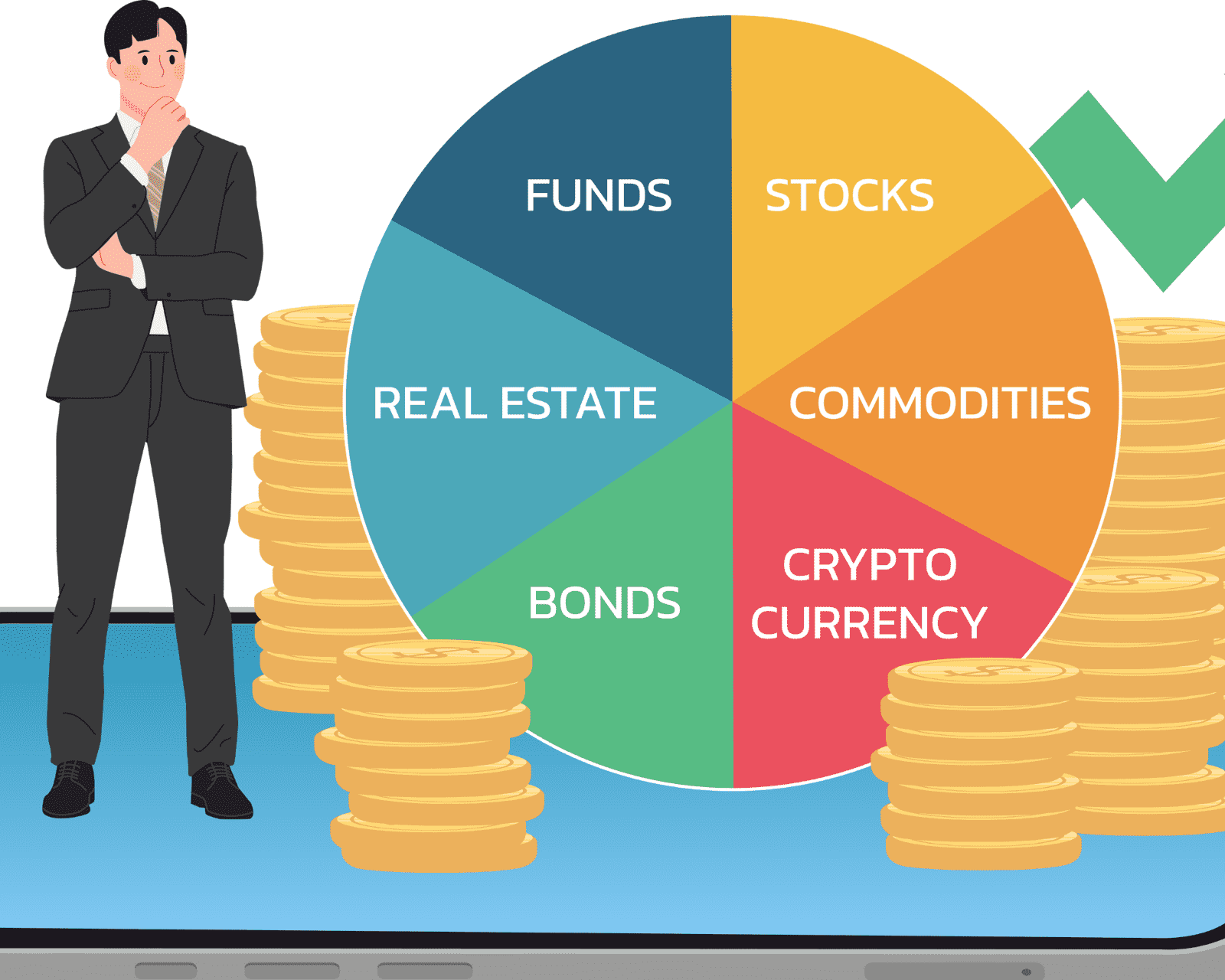

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.