How to Get Out of Debt on a Low Income: 5 Tips

Getting out of debt on a low income can be challenging, but it's not impossible. Here are some tips that can help.

1. Create a budget

Make a list of your expenses and income to track where your money goes.

Cut back on non-essential expenses like eating out, subscriptions or buying unnecessary things.

2. Increase your income

You can look for part-time jobs, sell your unwanted items, or ask for a raise.

3. Pay off high-interest debts first

Start with the debt that has the highest interest rate, and make sure to pay at least the minimum payment on all other debts.

4. Consolidate debt

Consider consolidating your debts into one payment with lower interest rates.

5. Seek professional help

If you're struggling to manage your debts, consult a credit counselor or financial advisor. They can help you create a personalized plan to get out of debt.

Remember to stay motivated and committed to your plan, and don't hesitate to ask for help when you need it.

How to Get Out of Debt on a Low Income: 5 Tips

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

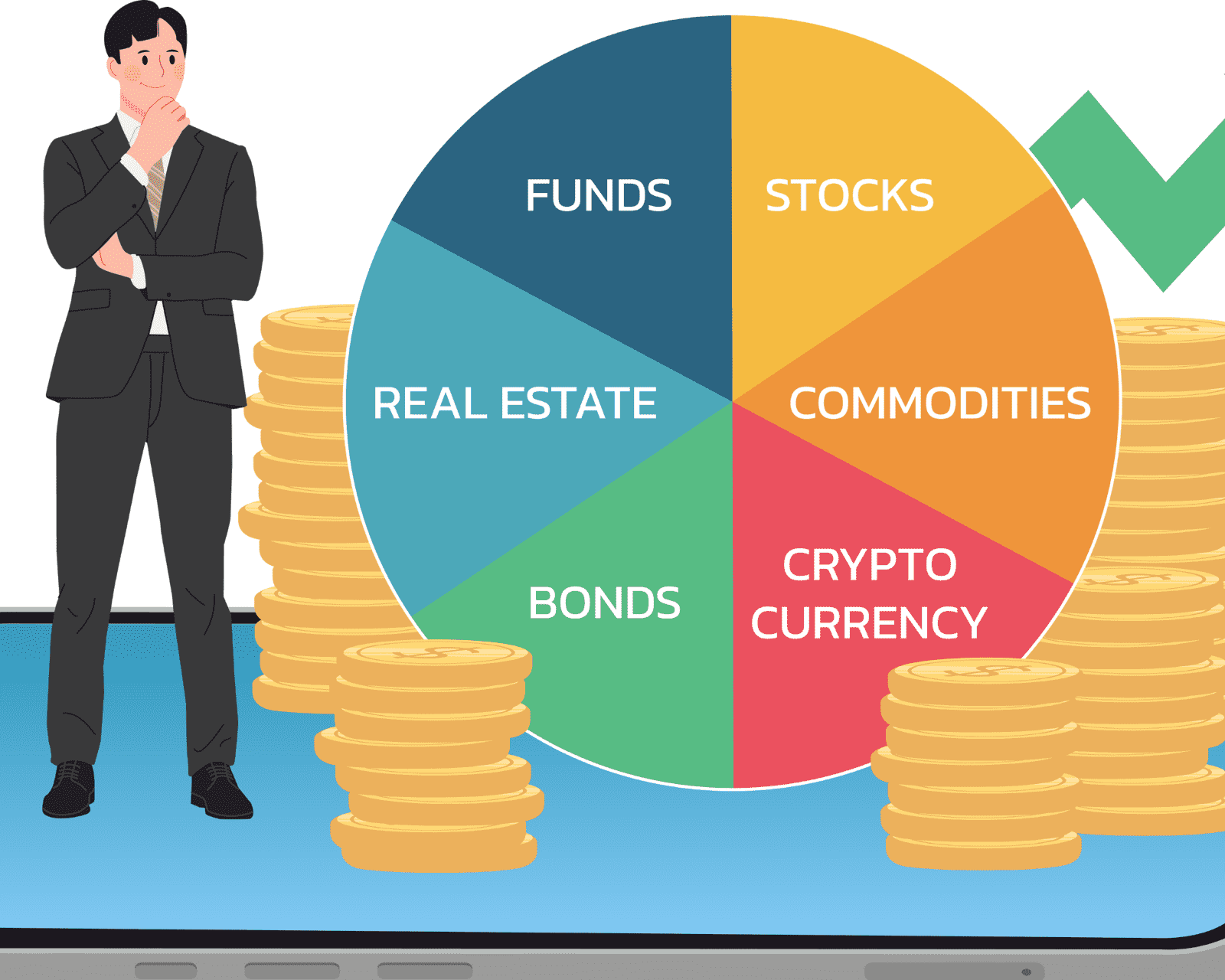

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.