How To Buy Home with Bad Credit and No Money down: 3 Top Options

Buying a home can be a daunting task, especially for those with bad credit and no money down. The good news is that it is possible, but it requires some research, creativity, and patience.

First and foremost, it is essential to understand what bad credit means. Bad credit is a term used to describe a person's history of not paying their debts on time or not paying them at all. This history is reflected in a credit score, which ranges from 300 to 850. A credit score of 580 or below is typically considered bad credit.

If you have bad credit and are interested in buying a home with no money down, there are several option to buy home with bad credit and no money down to explore.

1- FHA loan program

One option to buy home with bad credit and no money down is the Federal Housing Administration (FHA) loan program. The FHA is a government agency that insures loans made by private lenders. FHA loans are designed to help individuals with lower credit scores and smaller down payments buy homes.

The minimum credit score required for an FHA loan is 580, and borrowers can potentially qualify for a loan with a down payment as low as 3.5%.

2- USDA Rural Development loan program

Another option to buy home with bad credit and no money down is the United States Department of Agriculture (USDA) Rural Development loan program. This program is designed to help low-income individuals and families living in rural areas purchase a home. The USDA loan program does not require a down payment, and the minimum credit score required is typically lower than for conventional loans.

3- VA loan program

A third option to buy home with bad credit and no money down is the Veterans Affairs (VA) loan program. This program is available to active-duty service members, veterans, and surviving spouses. VA loans do not require a down payment, and there is no minimum credit score requirement.

It is essential to note that these loan programs may have specific eligibility requirements, so it is important to research each program carefully to determine if you qualify.

If none of these options work for you, there are still other ways to buy a home with bad credit and no money down. One option is to work with a seller who is willing to finance the purchase. This means that instead of a traditional mortgage, the buyer makes monthly payments directly to the seller.

Another option is to look for a rent-to-own property. In this scenario, the buyer rents the property for a set period with the option to purchase the home at the end of the lease term.

Buying a home with bad credit and no money down may seem daunting, but with some research and creativity, it is possible to achieve the dream of homeownership. It is important to remember that improving your credit and saving for a down payment should still be a priority, as it can save you money in interest and potentially qualify you for more favorable loan terms in the future.

How To Buy Home with Bad Credit and No Money down: 3 Top Options

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

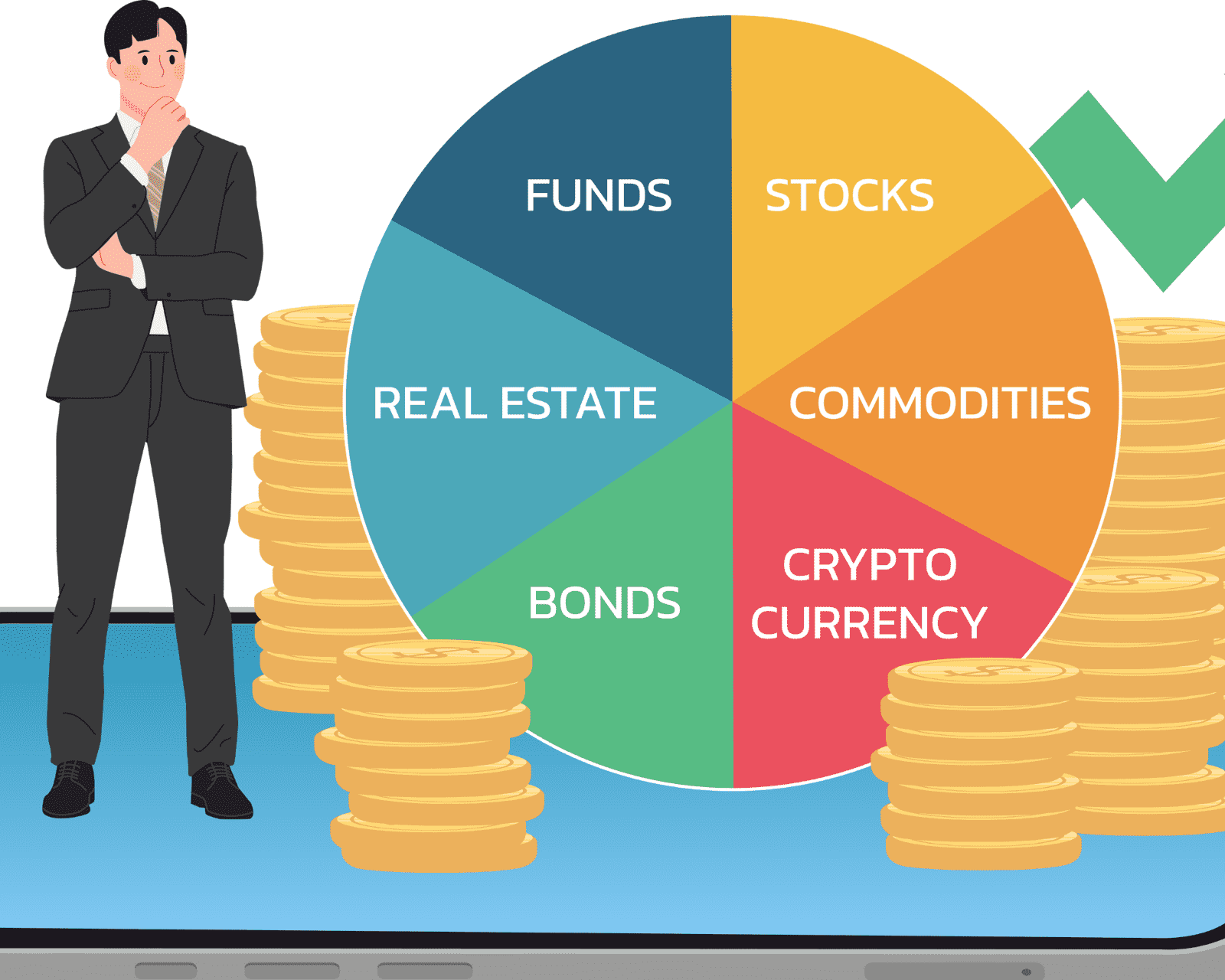

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.