How to borrow Money from Bank to buy Home wisely?

Waiting until accumulating enough money to buy home, then the price of that house has increased. Therefore, borrowing money from bank to buy home is the solution that many people choose now. However How to borrow Money from Bank to buy Home wisely without burying all your youth in that bank debt is an art.

1- Don't buy Home when you don't have enough accumulation

Currently, many banks lend money to buy home up to 70-80% of the house value, which means that you only need to have 20-30% of the house's value in hand to get a mortgage loan. However, the more you borrow, the higher the monthly payment!

Therefore, you should only borrow up to 30-40% of the house value that you want to buy, which means you have accumulated about 60-70% of the house price. This is considered the golden ratio to balance between life and monthly mortgage loan payments.

If you want to borrow more, you need to make sure that you or your spouse are financially strong enough to bear the burden of bank interest.

When you borrow Money from Bank to buy Home, you should not calculate too close to your income, you should not be optimistic but must look clearly at reality - if you do not want to meet risks later and putting heavy pressure on your daily life.

Credit experts point out that you should only spend up to 40% of your total monthly income on buying a home. This is the norm so that you can ensure a normal life, without to much pressure or fall into the situation of losing the house.

2- Buy Home that suits your financial ability

It is difficult for you to buy a good house – that is, both cheap and valuable right in the city center.

Many people still try to buy a city house when they don't have too much money in hand, so they fall into the situation of losing their ability to pay the bank loan.

Instead, you should buy an affordable house to make your daily life more comfortable. You should spend time to search more and expand the search scope to the suburban areas.

3- Leasing the house that you bought

Have you ever heard the saying "buy a house but pay with someone else's money"? This sentence means that you borrow money to buy a house and then lease it to other, use the leasing money amount and a part of your own money to pay off their bank loan monthly.

This is a great way to reduce the pressure of paying off your monthly bank debt. During this period, you can continue to live with your parents or rent a cheap house to live temporarily, just make sure your home rental fee is at least 2 times less than what you get from leasing the house that you borrow Money from Bank to buy.

The downside of this approach is that when you officially move into this house, it is no longer as new as the original. However, you just need to clean and redecorate the interior according to your own aesthetic taste, then there is no problem anymore.

4- Try to pay off the Bank Loan early

A reasonable home loan will be a good motivation for you to work on increasing your income and expanding the way you make money. It will help you improve your working productivity thereby opening up good promotion opportunities.

Once you have increased your income, you can think about paying off your bank debt early. However, you should carefully ask the bank staff about when you can settle down the payment without penalty and how the penalty fee is calculated, if any.

Many people regret of the 2-4% penalty fee (depending on the policy of each bank) so they bring that money amount to the bank to earn monthly interest. However, the savings interest rate is only a very small amount compared to the monthly mortgage interest rate, so it is not a wise solution.

How to borrow Money from Bank to buy Home wisely?

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

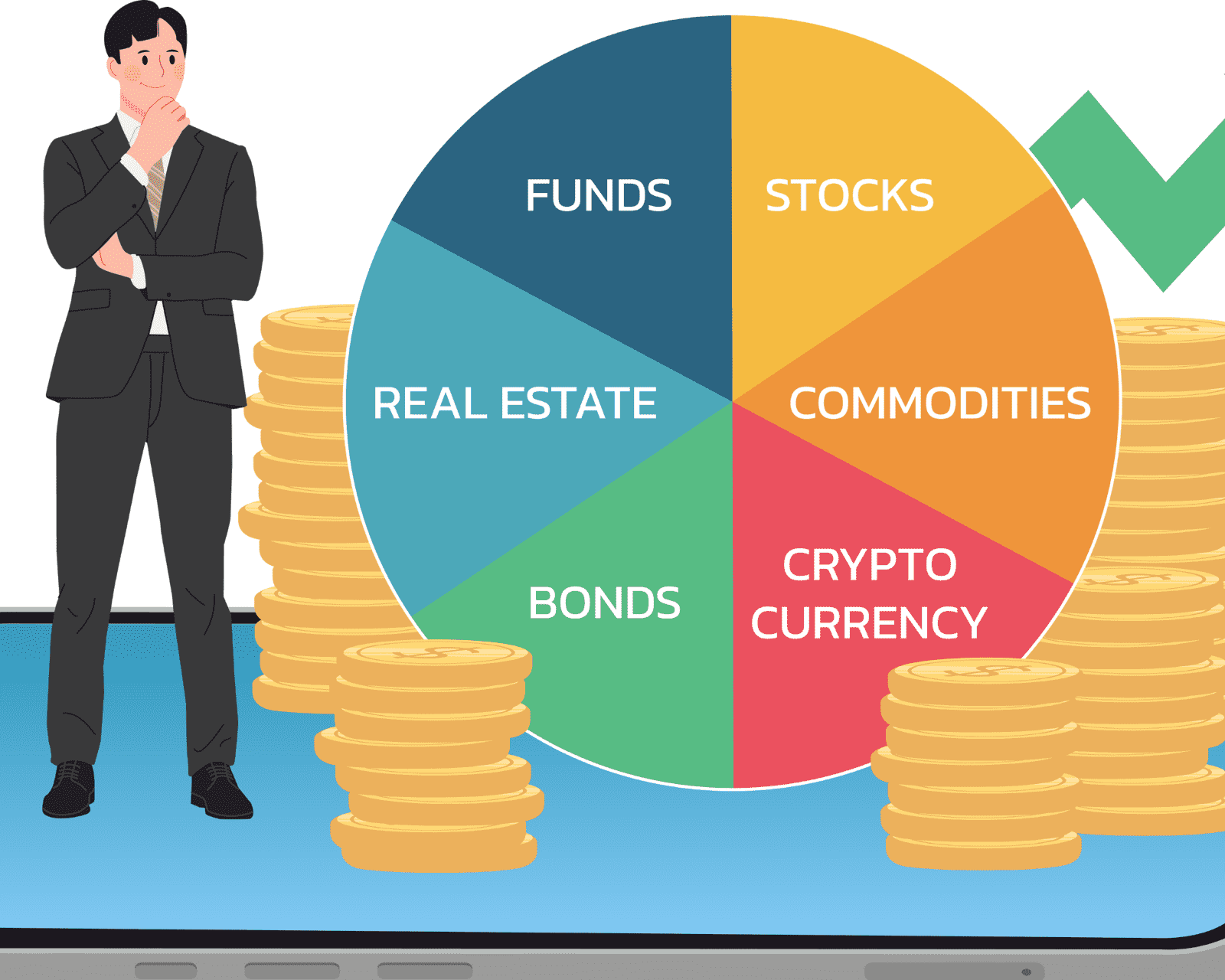

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.