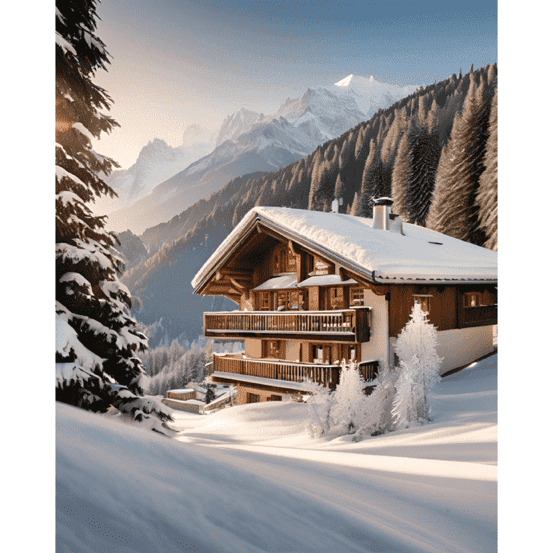

French Alps Chalet Owners Face €200,000 Exit Fees

Ski chalet owners in the French Alps confront exit fees up to €200,000, sparking legal action over broken promises in leaseback agreements.

In a perplexing turn of events, numerous individuals are now pursuing legal recourse after being assured that they would not incur any charges upon exiting a widely popular tax-advantaged leaseback scheme orchestrated by companies such as Pierre & Vacances.

Hundreds of owners of holiday ski chalets, who eagerly embraced a tax-beneficial initiative championed by the French government in the early 2000s, are now confronted with staggering bills that could soar to €200,000 at the conclusion of their contracts. Alternatively, they face the daunting prospect of engaging in costly legal battles to contest these exorbitant fees.

These beleaguered property owners, including a significant number of Britons, were enticed into purchasing properties under a leaseback scheme that promised not only financial incentives but also the opportunity to rent their homes to tourists. The allure was undeniable: buyers were exempt from the typical 20% VAT levied on property purchases and were granted the privilege of using their holiday homes for up to six weeks annually, all in exchange for a 20-year leasing commitment. During this period, they were also poised to benefit from a steady stream of income generated by tourist rentals.

Pierre & Vacances (P&V), a prominent player in the French holiday rental market and operator of Center Parcs, managed a substantial portion of these lettings. The company had previously assured investors that they would not be subjected to any exit charges—fees that leaseback companies are entitled to impose at the end of the lease term to compensate for the anticipated loss of income. This fee, known as an “eviction indemnity,” typically ranges from one to three years' worth of the apartment's turnover.

However, in a shocking reversal, P&V has now declared that it cannot be bound by this prior commitment, leaving many chalet owners grappling with exorbitant bills or trapped in their property contracts until a resolution is reached. After enticing landlords to sign on the dotted line with the promise of no eviction compensation claims at the lease's conclusion—an assurance reiterated even after the leases were executed—P&V is now demanding astronomical sums from these unsuspecting owners.

A significant number of the affected properties are situated in Arc 1950 (Savoie), nestled in the picturesque French Alps. In 2009, P&V acquired approximately 650 commercial leases from the Canadian developer Intrawest, pledging not to seek compensation from owners at the end of their leases. The VAT savings associated with the scheme allowed couples to purchase apartments for around €300,000 instead of the market price of €350,000. However, as their lease expired on April 30 of this year, they informed P&V of their decision not to renew, only to receive a letter stating that failure to renew would result in a staggering €150,000 eviction indemnity.

The crux of this situation raises a critical question: how is it that a large corporation, which received a bailout from the French government in 2021, is able to exploit overseas investors who purchased property under a government-promoted leaseback scheme without facing any repercussions? The irony is palpable, and the implications for those affected are nothing short of alarming.

French Alps Chalet Owners Face €200,000 Exit Fees

Greece: Europe’s Fourth Cheapest Real Estate Market

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy investors seeking value and opportunity.

Surge in Scottish Home Sales: UK Real Estate Update

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth in years, signaling a vibrant market.

Spain: A Leading Market in European Real Estate

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail, logistics, and hotel sectors for strategic growth.

Greece Real Estate Market: Rise of Serviced Apartments

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services attract savvy investors in the Greece real estate market.

Home Prices Hit by Climate Change, J.P. Morgan Warns

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.