Australia’s Queensland Emerging Top Destination for Investors: Discover Why

The number of investor loans in Australia has been on the rise in recent months, with one state standing out as a top choice among investors. New lending indicators data from the Australian Bureau of Statistics reveals that new investor loan commitments nationwide have increased by 11.6% in value from February to July 2023. While most states have experienced growth in investor loans, Queensland has seen an impressive 31% increase in loan value since February, almost three times the national level. This surge reflects the state's popularity among buyers looking for investment properties.

Let's delve into the factors driving this trend and explore why Queensland is becoming the go-to destination for investors.

The Popularity of Queensland Among Investors

Suburb-level Investor Data Reinforces Queensland's Appeal

According to suburb-level investor data, prime locations in Queensland are in high demand among potential investors. Surfers Paradise and South Port in the Gold Coast region, along with Brisbane City, have emerged as the top five most inquired-about suburbs for investment. In fact, the combined number of inquiries for these locations surpasses that of Melbourne, Adelaide, and Sydney combined. This trend highlights the increasing interest in Queensland's property market and underscores its appeal as a promising investment destination.

Factors Driving Investor Interest in Queensland

Affordable Median Sale Prices

One of the key factors attracting investors to Queensland is the state's comparatively affordable median sale prices. Unlike other parts of Australia, where house and unit prices exceed the national median, Queensland remains a market where prices are below the national average. Currently, the national median prices stand at $735,000 for houses and $565,000 for units, while in Queensland, houses have a median price of $670,000 and units are priced at $506,000. This affordability makes Queensland an attractive option for investors seeking value for their money.

High Rental Yields

Another appealing aspect for investors is the high rental yield in Queensland. Rental yield is the return on investment after deducting costs. With the median yield in Queensland standing at 4.8%, surpassing the national median of 4.2%, investors can enjoy higher returns on their investment in the state's property market. This higher rental yield, combined with affordable purchase prices, creates a favorable investment climate for those looking to maximize their returns.

Growth in Weekly Advertised Rent

Queensland has recorded the second-highest annual growth in weekly advertised rent across all states. Since September 2022, rents in the state have increased by an impressive 13%. This upward trend indicates strong demand in the rental market, providing investors with the potential for increased income from their investment properties. The growth in weekly advertised rent, coupled with attractive rental yields, positions Queensland as an enticing option for investors seeking a stable and profitable rental market.

Investor Loans Resurgence in the Market

Re-Entry of Investors into the Market

The recent trends in investor loans suggest a resurgence of interest in the market after many investors exited during the pandemic and throughout 2022. This renewed confidence is reflected in the increased loan commitments seen across various states. As investors flock back into the market, Queensland's appeal as a prime investment destination becomes even more pronounced.

Queensland's rise as the top destination for investors in Australia can be attributed to several factors. The combination of affordable median sale prices, high rental yields, and the recent surge in investor loan commitments has positioned the state as an attractive and lucrative investment option. With its diverse range of suburbs generating significant buyer interest, Queensland offers investors the potential to reap substantial returns. As more investors enter the market and contribute to the already tight rental market, this trend is set to continue, benefiting both investors and the overall property market in Queensland.

FAQs:

1. What are the main reasons investors are choosing Queensland over other states?

- The main reasons investors are choosing Queensland include the state's affordable median sale prices, high rental yields, and recent growth in investor loan commitments.

2. Which suburbs in Queensland are most favored by potential investors?

- Surfers Paradise and South Port in the Gold Coast region, along with Brisbane City, are among the top five most inquired-about suburbs by investors in Queensland.

3. How does Queensland's rental market compare to the national market?

- Queensland has recorded the second-highest annual growth in weekly advertised rent among all states, indicating a strong and buoyant rental market.

4. Are investors returning to the market after the impact of the pandemic?

- Yes, the recent trends in investor loans imply that investors are re-entering the market after many had exited during the pandemic and throughout 2022.

5. How will the influx of investors impact Queensland's tight rental market?

- The return of investors to the market is expected to provide a welcome boost to Queensland's already tight rental market, as demand for rental properties increases.

Australia’s Queensland Emerging Top Destination for Investors: Discover Why

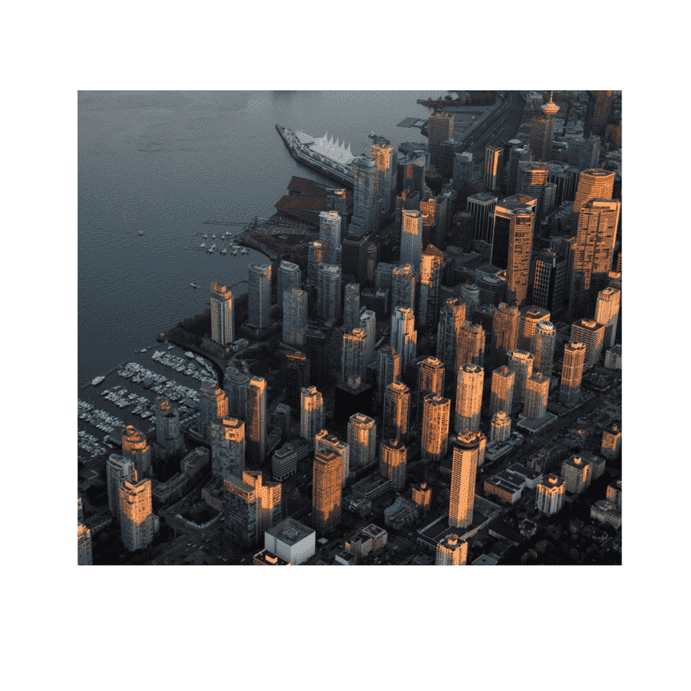

Luxury Homes for Sale in Vancouver, Canada | Real Estate Market Analysis

Luxury Homes for Sale in Vancouver, Canada | Real Estate Market Analysis

Explore the thriving real estate market in Vancouver, Canada, and discover the stunning luxury homes available in popular neighborhoods. Get tips for buying and selling luxury properties.

Vancouver Housing Market Predictions 2025 | Analysis & Insights

Vancouver Housing Market Predictions 2025 | Analysis & Insights

Explore the current state of the Vancouver housing market and gain valuable insights into its future trends and predictions for 2025. Understand the challenges and opportunities in this vibrant real estate market.

German Creditor Seizes Control of Facebook’s Dublin Office Amid Real Estate Struggles

German Creditor Seizes Control of Facebook’s Dublin Office Amid Real Estate Struggles

Discover the impact as a German creditor takes control of Beckett Building, Facebook's Dublin headquarters. This article explores the details of the seizure and the wider implications for the struggling real estate market in the Irish capital.

Prediction Today: House Prices in Ireland 2024

Prediction Today: House Prices in Ireland 2024

Looking at the current trends in the housing market in Ireland, it seems that house prices in Ireland 2024 are set to continue their upward climb.