3 Best Debt Management Solutions

Good debt management skills will help you confidently live a better life.

Here are 3 best debt management solutions for you to gain some skills.

I- Determine good debts & bad debts

Not all debts are bad. Identifying your debts will help you better control your debts.

1- Good debts

If you use debt on an investment asset, the source of repayment is the money generated from the asset, this is good debt which means that some of your debt can be considered investments.

If you use debts to buy valuable things and contribute to the growth of your budget, rest assured that it is good debt. For example, buying a house for lease, student loans to cover tuition fees,..

2- Bad debts

Bad debts are assets that are not profitable, making it difficult for us to re-pay the loan. When you use money to buy things that will be consumed, it's not good debt. It can even create some instability for your financial situation.

The debt that you use to pay for your vacation is considered bad debt. Even if it gives you retreat and productivity after returning, a vacation is not appreciated in terms of financial value. You should limit the use of debt to pay for vacation especially when you know you can't afford to pay.

II- Understand the loans thoroughly to reduce risks

Good debt is only achieved when you can make wise decisions about your future. When analyzing the financial picture, you are trying to decide the ability to pay the debt, usually, we should focus on dealing with debts from credit cards, auto loans and other mortgages.

Some people plan to use good debts to pay off bad debts. It's not a good idea to pay off one debt with another. Thorough consideration before making any financial decisions will help you minimize risks.

III- Make a plan to pay off the loans on time

You must repay your loan on time if you don't want to put extra pressure on your finances. So thinking about this plan first is always a good choice. As soon as you have a detailed list of the important numbers about your personal finances, what you need to do is create a loan repayment plan for yourself.

1- Limit or stop creating new debts

This is not easy, because life is very unpredictable, maybe one day you will get excited and buy an expensive item that increases your credit debt. This will negatively affect your loan repayment plan, so you should restrain yourself from immediate unnecessary needs.

Spending money on shopping after tiring working days or buying the items you like, going to the tourist places you want is a great thing. Even if you don't have a lot of money, there are personal loan offers to support you to do. And that leads to having debts that need to be paid. If you continue with such a cycle and pace of life, it will increasingly affect your ability to pay debts.

If you really want to pay off your debts, it's best not to add new debts. Because if you have just paid off one debt and immediately have another, your efforts will obviously be in vain. And debts will pile up again, consider your debts as an expense to pay and your budget is limited.

Thinking of it as a goal you need to work towards, and the needs for enjoyment are the things that hold you back from reaching that goal. You can motivate yourself to put aside your immediate desires and focus on more important goals. Then that enjoyment is seen as a reward for your efforts.

2- Remember the interest rate of each debt

Remember the interest rate of each debt is also very important. Except for loans from relatives, family and friends, other debts have interest rates attached.

With loans such as: bank loans, credit card debts, installment loans, ... all have interest rates on a daily or monthly basis.

In short, whether you borrow or owe in any form, you should pay attention to the term that you need to pay monthly or yearly to be proactive in repaying the debt. Avoid the situation of payment penalty fees. If you do not know the monthly and yearly interest rates to be paid for each loan or credit card, you can look at your monthly statement, check your online account management page or call to the card issuer to get details. Don't let yourself be confused with interest rates or penalty fees of the loan.

After determining the total actual debts, know the interest rate for each loan, calculating the amount of interest to be paid each month or year. Prioritize paying off high-interest loans or short-term loans, because these debts will require you to spend a large amount of money to pay your creditors monthly or the interest rate and penalty fees will increase significantly if not paid on time.

3- Think about paying off debt as soon as you have money

All success comes from habits. And to successfully pay off debt, you should also build a scientific spending habit.

If you are in debt and want to pay it off, think about paying it off as soon as you have money. This doesn't mean you have to use up all of your income to pay off your debt as you need money for personal expenses and living. The fact that clear awareness of the debt amount to pay will make your debt reduce efficiently which will make you feel much more comfortable later.

Take a look at the numbers, pay special attention to your income and expenses, arrange your expenses in descending order of importance, then look at the expenses ranked last and decide what to do with them.

Consider the necessity of them to see whether it is possible to cut them off in the following months until the debt is paid off? Try to make the difference between income and expenditure as large as possible. Looking at that difference, you also need to come up with a specific number you will use to pay debts each month after subtracting other savings. After you have set a target number, you must definitely follow it, especially do not use them to spend on other items.

4- Increasing income is the fastest way to pay off debts

One of the ways to quickly pay off debts is to find other jobs to increase income. Having more revenue means a better chance to get out of debt sooner. You can get additional professional work at your current company or another company. Working part time in the evening shift with a completely new job, working overtime, working as a Freelancer at home, selling online,..

These are all ways to earn money quickly to pay off debts that you can use and choose for yourself a suitable job in terms of professional ability as well as time and health condition.

You should ask yourself two questions before deciding to take out a loan:

- This loan is for investment or consumption purposes

- If it is a consumer loan, whether the recurring payment amount is more than half of your income after deducting your expenses.

3 Best Debt Management Solutions

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Unlocking Banking Hacks for Saving Money: Your Path to Wealth

Discover effective banking hacks for saving money and grow your wealth in today's unpredictable economic conditions.

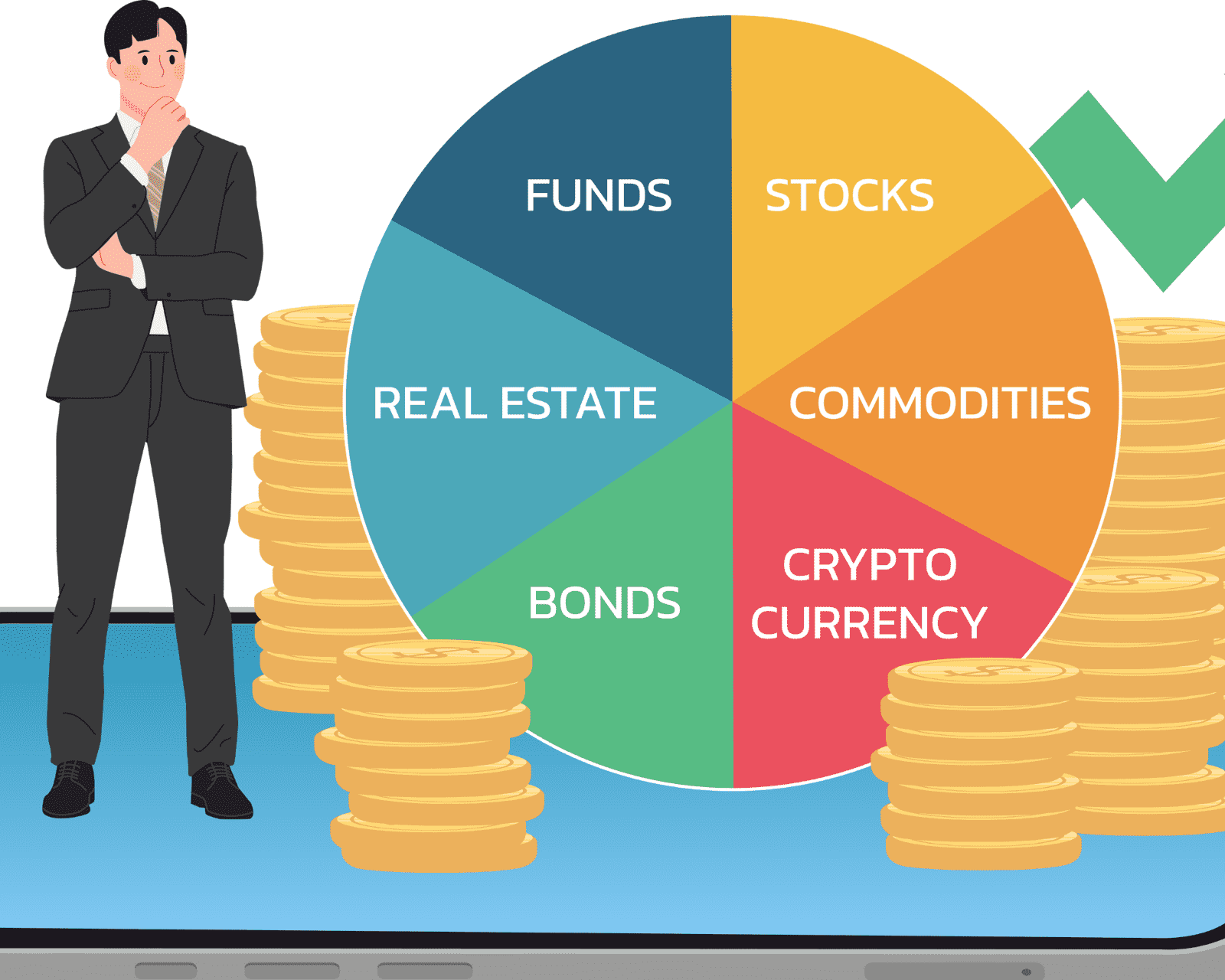

Best Place to Invest Money Right Now

Best Place to Invest Money Right Now

Investing money in the right place can yield great results and help individuals achieve their financial goals. However, with numerous investment options available, determining the best place to invest money right now can be a daunting task.

What is the Safest Investment with the Highest Return?

What is the Safest Investment with the Highest Return?

Investing money is a common practice for individuals looking to grow their wealth. However, with the ever-present uncertainty in financial markets, finding a safe investment with a high return can be challenging.